Choosing the right life insurance policy can be a daunting task, especially with the numerous options available in the market.

As we step into 2025, it’s essential to understand the top picks that can provide the best coverage for you and your loved ones.

With so many insurance providers offering various plans, it’s crucial to evaluate and compare the different policies to find the one that suits your needs.

This article aims to guide you through the process, highlighting the best life insurance options available in 2025.

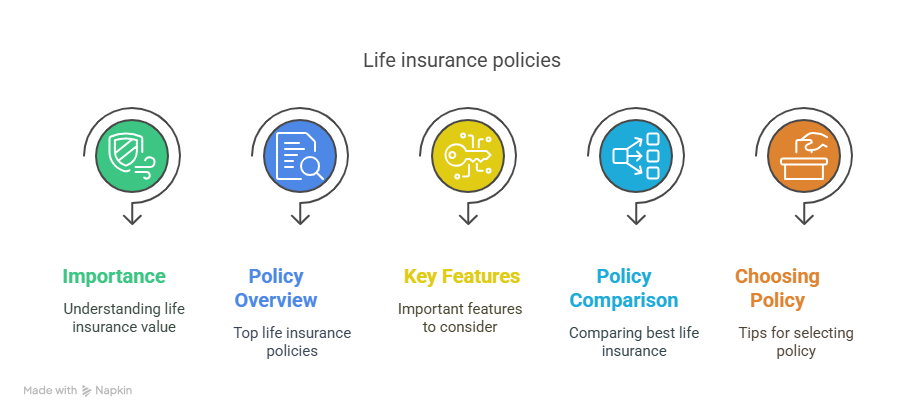

Key Takeaways

- Understanding the importance of life insurance in 2025

- Overview of top life insurance policies

- Key features to look for in a life insurance policy

- Comparison of the best life insurance options

- Tips for choosing the right life insurance policy

Understanding Life Insurance Basics

Navigating the world of life insurance can be daunting, but understanding its basics is the first step towards making an informed decision. Life insurance serves as a financial safety net for your loved ones in the event of your passing.

Types of Life Insurance Policies

There are several types of life insurance policies available, each catering to different needs and financial goals.

- Term Life Insurance: Provides coverage for a specified period.

- Whole Life Insurance: Offers lifetime coverage with a cash value component.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest.

Factors That Determine the Best Policy for You

Choosing the right life insurance policy depends on several factors, including your age, health status, financial obligations, and dependents. It’s essential to compare life insurance plans from top life insurance companies to find the one that best suits your needs.

Which Life Insurance Is Best: Comparing Top Policies of 2025

As we navigate the life insurance landscape of 2025, comparing term life, whole life, and universal life insurance is key. With numerous options available, understanding the differences between these policies is crucial for making an informed decision that suits your needs and budget.

Term Life Insurance

Overview

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It pays a death benefit if the insured dies during the term but does not accumulate a cash value.

Pros

- Affordability: Term life insurance is generally more affordable than other types of life insurance, making it accessible to a wider range of people.

- Simplicity: The straightforward nature of term life insurance makes it easy to understand and purchase.

Cons

- No Cash Value: Unlike whole life insurance, term life does not build cash value over time.

- Coverage Ends: If you outlive the term, coverage ends, and there is no payout unless you renew or convert the policy.

Features

Term life insurance policies often come with features like convertibility to whole life insurance and renewability without requiring evidence of insurability.

Whole Life Insurance

Overview

Whole life insurance, also known as permanent life insurance, covers the insured for their entire life, provided premiums are paid. It also accumulates a cash value over time.

Pros

- Lifetime Coverage: As long as premiums are paid, whole life insurance provides a guaranteed death benefit.

- Cash Value Accumulation: A portion of the premiums goes into a savings component that grows over time.

Cons

- Higher Premiums: Whole life insurance is more expensive than term life insurance.

- Complexity: The cash value component and dividends (if applicable) can make whole life insurance more complex.

Features

Whole life insurance policies often feature level premiums, guaranteed death benefits, and the potential for dividends from the insurer.

Universal Life Insurance

Overview

Universal life insurance combines a death benefit with a savings component, offering flexibility in premium payments and adjustable death benefits.

Pros

- Flexibility: Policyholders can adjust premiums and death benefits within certain limits.

- Cash Value Growth: The cash value can grow based on interest rates or investment performance.

Cons

- Complexity: Managing the cash value and adjusting premiums or death benefits can be complex.

- Risk of Lapse: If the cash value is insufficient to cover costs, the policy may lapse.

Features

Universal life insurance policies often include flexible premiums, adjustable death benefits, and the potential for tax-deferred growth of the cash value.

| Insurance Type | Coverage Period | Cash Value | Premiums |

|---|---|---|---|

| Term Life | Specified term (e.g., 10-30 years) | No | Generally lower |

| Whole Life | Lifetime | Yes | Generally higher |

| Universal Life | Flexible | Yes | Flexible |

Top Life Insurance Companies in 2025

Choosing the best life insurance company in 2025 requires a thorough understanding of the market’s top players. With numerous insurers offering a range of policies, it’s essential to identify companies that stand out for their life insurance benefits and customer service.

New York Life – Best for Whole Life Insurance

New York Life is renowned for its whole life insurance policies, offering guaranteed cash value accumulation and stable dividends. Their policies are designed to provide lifetime coverage with a cash value component that grows over time.

Haven Life – Best for Term Life Insurance

Haven Life specializes in term life insurance, offering affordable rates and a streamlined application process. Their policies are ideal for those seeking coverage for a specific period.

Northwestern Mutual – Best for Universal Life Insurance

Northwestern Mutual offers universal life insurance policies that provide flexible premiums and adjustable death benefits. Their policies are designed to adapt to changing needs over time.

Bestow – Best for Affordability

Bestow is recognized for its affordable life insurance options, offering term life insurance with competitive rates. Their online platform makes it easy to compare and purchase policies.

State Farm – Best for Customer Service

State Farm is known for its exceptional customer service, offering a range of life insurance policies with personalized support. Their agents are available to guide customers through the process.

When choosing the right life insurance policy, it’s crucial to consider these top insurers and their specialties to find the best fit for your needs.

Conclusion

Selecting the best life insurance policy can be a daunting task, but with the right information, you can make an informed decision. As discussed, various life insurance policies are available, including term life, whole life, and universal life insurance. Top insurance companies like New York Life, Haven Life, and Northwestern Mutual offer a range of policies to suit different needs.

To simplify your decision-making process, consider referring to a life insurance comparison chart that outlines the key features and benefits of each policy type. This will enable you to compare policies and choose the one that best aligns with your financial goals and provides adequate coverage for your loved ones.

By understanding your options and comparing policies, you can secure the right life insurance coverage and enjoy peace of mind knowing that your family’s financial future is protected.

FAQ

What is the best life insurance policy for a young family?

The best life insurance policy for a young family often depends on several factors, including income, expenses, debts, and the number of dependents. Term life insurance is often considered a good option as it provides coverage for a specific period, usually until the children are grown and self-sufficient.

How do I compare life insurance plans?

To compare life insurance plans, consider factors such as coverage amount, premium costs, policy duration, and any additional features or riders. You can also use a life insurance comparison chart to visualize the differences between various policies and insurers.

What are the benefits of whole life insurance?

Whole life insurance provides a guaranteed death benefit, a cash value component that grows over time, and fixed premiums. It also offers a guaranteed rate of return, making it a stable investment option. Additionally, whole life insurance can be used to supplement retirement income or pay for final expenses.

Can I get affordable life insurance quotes online?

Yes, many insurance companies, such as Bestow, offer online quotes and applications. You can compare quotes from multiple insurers and choose the one that best fits your budget and needs. Some insurers also offer instant or accelerated underwriting, making it easier to get coverage quickly.

What factors determine the cost of life insurance?

The cost of life insurance is determined by several factors, including age, health, lifestyle, occupation, and hobbies. Insurers also consider medical history, family medical history, and the amount of coverage desired. Generally, the healthier you are and the younger you are when you purchase a policy, the lower your premiums will be.

How do I choose the right life insurance policy for my needs?

To choose the right life insurance policy, consider your financial goals, income, expenses, debts, and dependents. You should also assess your health and lifestyle to determine the type and amount of coverage that is best for you. Consulting with a licensed insurance professional can also help you make an informed decision.

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance provides coverage for your entire lifetime. Term life insurance is generally less expensive, but it does not accumulate a cash value. Whole life insurance, on the other hand, builds cash value over time, but is typically more expensive.