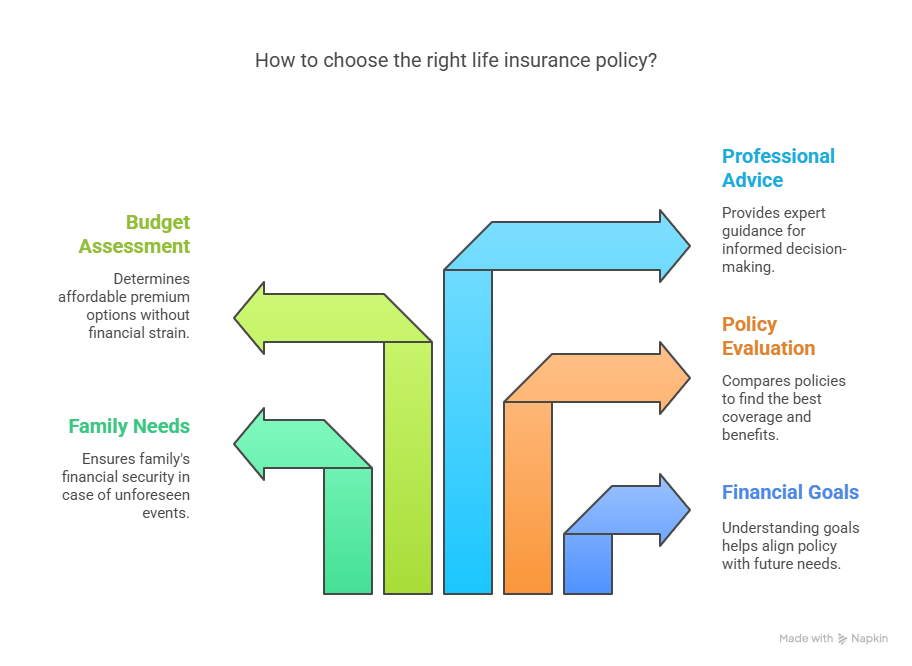

Choosing the right life insurance policy can be a daunting task, but it’s a crucial step in securing your family’s financial future.

With numerous options available, understanding the best life insurance options can help you make an informed decision.

Selecting the ideal policy involves considering several factors, including your financial goals, family needs, and budget.

By understanding these elements, you can navigate the complex landscape of life insurance and choose a policy that provides the right coverage for you and your loved ones.

Key Takeaways

- Understand your financial goals and how they impact your life insurance needs.

- Consider your family’s needs and how they will be affected by your choice.

- Evaluate different life insurance policies to find the best fit.

- Assess your budget to determine affordable premium options.

- Seek professional advice to make an informed decision.

Table of Contents

Understanding Different Types of Life Insurance

Navigating the world of life insurance can be daunting, but understanding your options is the first step towards making an informed decision. When it comes to choosing the right life insurance, there are several types to consider.

Term Life Insurance: The Basics

Term life insurance provides coverage for a specified period. It’s known for its simplicity and affordability.

Cost vs. Coverage Benefits

Term life insurance is often chosen for its cost-effectiveness, offering substantial coverage at a lower premium.

Ideal Candidates for Term Life

It’s ideal for those seeking temporary coverage, such as young families or individuals with significant debts.

Permanent Life Insurance Options

Permanent life insurance, on the other hand, covers you for your lifetime and includes a cash value component.

Whole Life vs. Universal Life

Whole life insurance offers fixed premiums and guaranteed cash value growth, whereas universal life insurance provides flexibility in premiums and death benefits.

Cash Value Considerations

The cash value component can be a valuable savings tool, but it’s essential to understand how it works.

Specialized Policies Worth Considering

There are also specialized life insurance policies designed for specific needs, such as final expense or mortgage protection life insurance.

What Life Insurance Should I Get? Factors to Consider

Life insurance is not a one-size-fits-all solution; it’s crucial to evaluate your personal circumstances to make an informed decision. When choosing a life insurance policy, several factors come into play.

Assessing Your Financial Needs and Goals

Understanding your financial obligations and future goals is essential. This includes considering your income, expenses, debts, and savings goals.

Income Replacement Calculations

One key aspect is determining how much income your dependents would need if you were no longer around. A common rule of thumb is to multiply your annual income by 5-10 times.

Debt and Future Expenses

Consider your outstanding debts, such as mortgages, car loans, and credit card debt, as well as future expenses like college funds for your children.

| Financial Obligations | Estimated Cost |

|---|---|

| Mortgage | $200,000 |

| Car Loan | $20,000 |

| Credit Card Debt | $5,000 |

| College Fund | $100,000 |

Family Situation and Dependents

Your family situation plays a significant role in determining the right life insurance coverage. Consider the number of dependents you have and their financial needs.

Age and Health Considerations

Your age and health status significantly impact your life insurance options and premiums. Generally, the younger and healthier you are, the lower your premiums.

How Medical History Affects Your Options

Pre-existing medical conditions can affect your eligibility for certain policies and your premium rates. Being upfront about your medical history is crucial.

No-Exam Policies: Pros and Cons

No-exam policies offer convenience but often come with higher premiums or lower coverage limits. Weighing the pros and cons is essential.

By carefully considering these factors, you can make an informed decision about what life insurance should you get and ensure you have affordable life insurance policies that meet your needs.

Finding Affordable Life Insurance That Meets Your Needs

When it comes to life insurance, the key is not just to find a policy that’s affordable, but one that also meets your specific needs. Achieving this balance requires understanding the various factors that influence both the cost and the coverage of a life insurance policy.

Balancing Coverage and Premium Costs

The first step in finding the right life insurance is to assess how much coverage you need versus what you can afford. Term life insurance is often more affordable than permanent life insurance, making it a viable option for those on a budget. However, it’s crucial to ensure that the coverage period aligns with your financial obligations.

For instance, if you have young children, you may want to consider a policy that covers you until they are financially independent. Calculating your coverage needs based on your income, debts, and future expenses can help you determine the right amount of coverage.

Policy Features and Riders Worth Paying For

While cost is a significant factor, certain policy features and riders can provide valuable additional benefits. For example, a waiver of premium rider can ensure that your policy remains in force if you become disabled and unable to pay premiums. Similarly, an accelerated death benefit rider can provide financial assistance if you’re diagnosed with a terminal illness.

Comparing Providers: Beyond the Price Tag

When comparing life insurance providers, it’s essential to look beyond the premium costs. Two critical factors to consider are the insurer’s financial strength ratings and their customer service reputation.

Financial Strength Ratings

Financial strength ratings, provided by agencies like AM Best, Moody’s, and Standard & Poor’s, indicate an insurer’s ability to pay claims. An insurer with a high rating is more likely to be around when you need to make a claim.

Customer Service Reputation

A provider’s customer service reputation can significantly impact your overall experience. Look for insurers known for their responsive and helpful customer service, as this can make a big difference when you need to file a claim or adjust your policy.

By carefully balancing coverage and premium costs, selecting valuable policy features and riders, and choosing a reputable provider, you can find affordable life insurance that meets your needs.

Conclusion

Choosing the right life insurance policy can be a daunting task, but with the right guidance, you can make an informed decision. As discussed in this life insurance buying guide, understanding your financial needs, family situation, and age are crucial factors in determining what life insurance you should get.

By considering these factors and balancing coverage with premium costs, you can find a policy that meets your needs. Whether you’re looking for term life insurance or a permanent life insurance option, it’s essential to compare providers and policy features to ensure you’re getting the best value.

Now that you’re equipped with the knowledge to make an informed decision, take the next step in securing your financial future. Start by assessing your needs and exploring your options to find the right life insurance policy for you.

FAQ

What are the main types of life insurance policies available?

The primary types of life insurance are term life insurance, whole life insurance, and universal life insurance. Term life provides coverage for a specified period, while whole life and universal life are permanent policies that also accumulate a cash value over time.

How do I determine the right amount of life insurance coverage I need?

To determine the appropriate coverage amount, consider factors such as income replacement needs, outstanding debts, future expenses like college tuition for dependents, and final expenses. Calculating these needs will help you decide on the right coverage amount.

What is the difference between whole life and universal life insurance?

Whole life insurance offers a fixed premium and a guaranteed death benefit and cash value accumulation. Universal life insurance is more flexible, allowing adjustments to premiums and death benefits, but it comes with more complexity and investment risk.

Can I get life insurance if I have health issues?

Yes, you can still obtain life insurance with health issues, but the premiums may be higher, and the process might involve more underwriting scrutiny. Some policies, like guaranteed issue life insurance, are designed for individuals with significant health problems, though they often come with higher premiums and lower coverage limits.

What are no-exam life insurance policies, and are they a good option?

No-exam life insurance policies allow applicants to skip the medical exam typically required for life insurance. They can be a good option for those who are short on time, have certain health conditions, or prefer not to undergo a medical exam. However, they often come with higher premiums or lower coverage limits.

How do I compare life insurance providers effectively?

When comparing life insurance providers, consider not just the premium costs but also the financial strength ratings of the insurer, customer service reputation, policy features, and available riders. A comprehensive comparison will help you find a provider that meets your needs and budget.

What are some valuable policy features or riders to consider?

Valuable policy features and riders include accelerated death benefit riders, waiver of premium riders, and long-term care riders. These can enhance your policy by providing additional benefits, such as accessing the death benefit if you’re diagnosed with a terminal illness or waiving premiums if you become disabled.