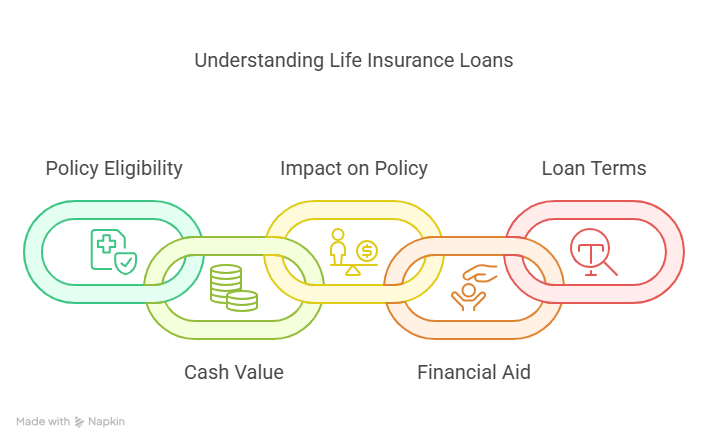

When considering financial options, many individuals overlook a potentially valuable resource: their life insurance policy. Specifically, certain types of life insurance allow policyholders to borrow against the policy’s cash value. This can provide a source of funds during financial hardships or for significant expenses.

Not all life insurance policies are created equal; some, like whole life or universal life insurance, accumulate a cash value over time, against which you can borrow. This feature can offer financial flexibility, but it’s crucial to understand the terms and implications.

Understanding the nuances of borrowing against a life insurance policy is essential. It can impact the policy’s death benefit and cash value. Nonetheless, for those who need access to cash, it can be a viable loan option.

Key Takeaways

- Borrowing is only available with certain life insurance policies, like whole or universal life.

- The loan is taken against the policy’s cash value.

- Borrowing can impact the policy’s death benefit and cash value.

- It’s a potential source of funds during financial hardships.

- Understanding the loan terms is crucial.

What Life Insurance Can You Borrow From?

Life insurance policies can serve as a financial safety net, but only certain types offer the ability to borrow against them. The key factor is the accumulation of cash value over time, which is a feature of some life insurance products.

Whole Life Insurance

Whole life insurance is one type of policy that allows borrowing. It accumulates a cash value over time, which can be borrowed against. This cash value grows at a guaranteed rate, making it a stable source of funds.

Universal Life Insurance

Universal life insurance is another type that offers borrowing capabilities. It combines a death benefit with a savings component, allowing policyholders to accumulate cash value. The cash value can be borrowed against, but it’s essential to understand the interest rates and repayment terms.

Variable Life Insurance

Variable life insurance policies also allow borrowing against the cash value. The cash value in these policies can fluctuate based on investment performance, which may impact the amount available for borrowing.

Why Term Life Insurance Doesn’t Qualify

Term life insurance does not accumulate cash value and, therefore, does not qualify for borrowing. It provides coverage for a specified term and is generally more affordable than whole life or universal life insurance, but it lacks the savings component.

How Borrowing From Life Insurance Works

Borrowing from your life insurance policy can be a viable financial option, but it’s crucial to understand how it works. When you purchase a life insurance policy, a portion of your premiums may accumulate as cash value over time, which you can borrow against.

Understanding Cash Value Accumulation

The cash value of your life insurance policy grows over time as you pay premiums. A portion of your premium payments goes towards the cost of insurance, while the remaining amount is invested, earning interest and increasing the cash value. This accumulated cash value serves as collateral for a policy loan.

Policy Loan Process and Requirements

To borrow against your life insurance policy, you’ll need to contact your insurance provider and request a policy loan. The process typically involves:

- Verifying your policy details

- Determining the available cash value

- Specifying the loan amount

The insurance company will then disburse the loan amount, and you’ll be required to repay the loan with interest.

Interest Rates and Repayment Terms

Policy loans often come with competitive interest rates, which can be fixed or variable. You’ll need to repay the loan, plus interest, to avoid reducing the policy’s death benefit. Repayment terms vary among insurance providers, so it’s essential to review your policy’s conditions.

Tax Implications of Life Insurance Loans

Generally, loans against a life insurance policy are not considered taxable income. However, if your policy lapses or is surrendered with an outstanding loan, the loan amount may be subject to taxation. It’s recommended to consult with a tax professional to understand the specific implications for your situation.

Pros and Cons of Borrowing Against Life Insurance

When considering borrowing against a life insurance policy, it’s essential to understand the benefits and drawbacks. Borrowing from cash value life insurance can provide access to cash when needed, offering a financial safety net during emergencies or for significant expenses.

However, borrowing life insurance can also have its downsides. The loan amount, plus interest, is deducted from the policy’s death benefit if not repaid, potentially reducing the amount received by beneficiaries. Furthermore, outstanding loans can also impact the policy’s cash value, affecting its long-term growth.

Understanding what life insurance can you borrow from and the implications of borrowing is crucial. Policyholders should carefully review their policy terms and consider their financial situation before making a decision. By weighing these factors, individuals can make informed choices about borrowing against their life insurance.

FAQ

What type of life insurance policy can I borrow from?

You can borrow from whole life, universal life, and variable life insurance policies, as these types accumulate cash value over time. Term life insurance policies do not have a cash value component, so borrowing is not an option.

How do I borrow against my life insurance policy?

To borrow against your life insurance, you’ll need to contact your insurance provider and request a policy loan. The process typically involves filling out a loan application and agreeing to the loan’s terms, including the interest rate and repayment schedule.

What are the interest rates on life insurance loans?

Interest rates on life insurance loans vary by insurer and policy. They are often competitive with other loan options and may be fixed or variable. It’s essential to review your policy documents or consult with your insurer to understand the interest rate associated with your loan.

Do I have to repay the loan from my life insurance policy?

While it’s not always required to repay a life insurance loan, any outstanding loan balance will reduce the policy’s death benefit if not repaid. Repayment terms can vary, and some policies may allow you to let the loan balance accumulate interest.

Are life insurance loans taxable?

Generally, life insurance loans are not considered taxable income, as they are loans rather than income. However, if your policy lapses or is surrendered with an outstanding loan balance, the loan amount may be subject to taxation.

Can I borrow from term life insurance?

No, term life insurance policies do not accumulate cash value, so borrowing against them is not possible. If you need to access cash, you may want to consider converting your term life policy to a permanent policy or exploring other loan options.

How does borrowing from cash value life insurance affect my policy?

Borrowing from your cash value life insurance can reduce the policy’s death benefit and cash value if not repaid. It’s crucial to understand the potential impact on your policy before taking out a loan.

What happens if I don’t repay my life insurance loan?

If you don’t repay your life insurance loan, the outstanding balance will accumulate interest, and the policy’s death benefit will be reduced. In extreme cases, if the loan balance exceeds the policy’s cash value, the policy may lapse.