Understanding whole life insurance can be a crucial step in securing your financial future. At its core, it is a type of permanent coverage that remains in effect for your entire lifetime, provided premiums are paid.

This type of insurance not only provides a death benefit but also accumulates a cash value over time, which can be borrowed against or used to supplement retirement income.

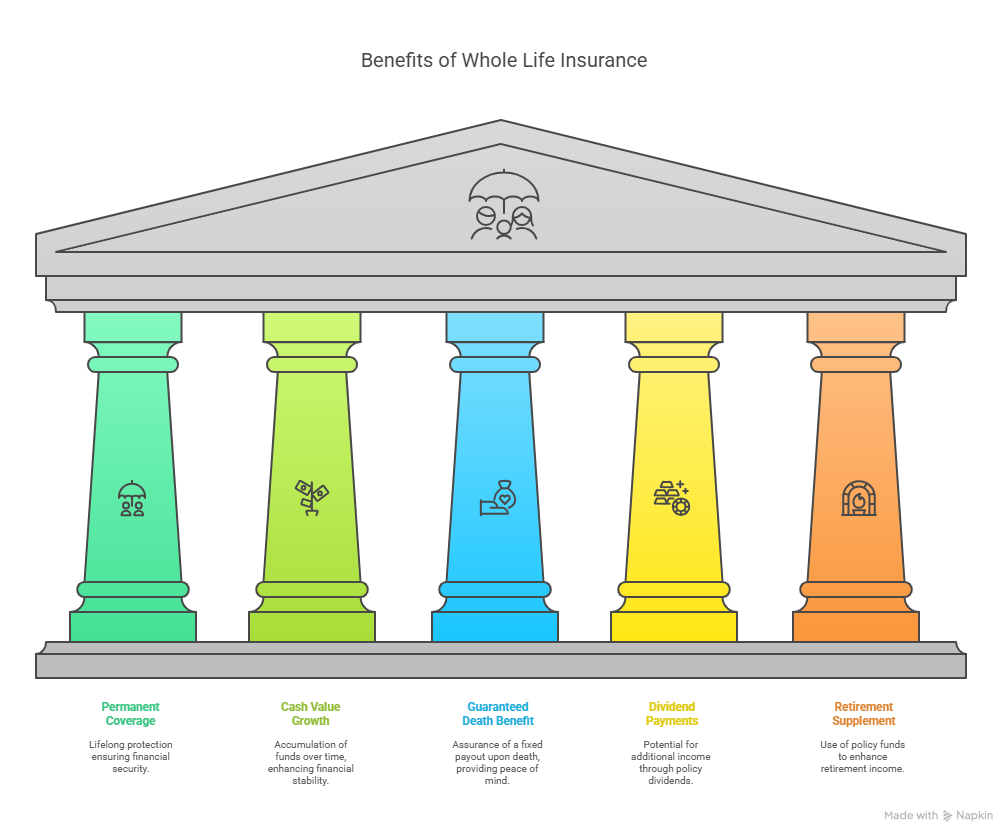

The benefits of whole life coverage include a guaranteed death benefit, a cash value component that grows at a fixed rate, and potentially, dividend payments.

Key Takeaways

- A type of permanent coverage that lasts a lifetime.

- Includes a cash value component that grows over time.

- Provides a guaranteed death benefit.

- May offer dividend payments.

- Can be used to supplement retirement income.

Whole Life Insurance Definition and Core Features

At its core, whole life insurance is designed to offer a death benefit and a cash value component that grows over time, making it a valuable financial tool. This type of insurance is also known as permanent life insurance because it provides coverage for an individual’s entire lifetime, as long as premiums are paid.

What Makes Whole Life Insurance “Permanent”

Whole life insurance is considered “permanent” because it does not expire after a specific term, unlike term life insurance. As long as premiums are paid, the policy remains in effect for the insured’s lifetime. This permanence provides a guaranteed death benefit to beneficiaries, regardless of when the insured passes away.

The permanence of whole life insurance also relates to its cash value accumulation feature. Over time, a portion of the premiums paid accumulates as cash value, which the policyholder can borrow against or withdraw.

Key Components of a Whole Life Policy

A whole life insurance policy typically includes two main components: the death benefit and the cash value.

- The death benefit is the amount paid to beneficiaries upon the insured’s death.

- The cash value is a savings component that grows over time, based on a portion of the premiums paid and any dividends earned.

Understanding these components is crucial to grasping the full value of a whole life policy definition. The cash value can be used in various ways, such as borrowing against it or using it to pay premiums.

How Whole Life Differs from Term Life Insurance

One of the primary differences between whole life and term life insurance is the duration of coverage. Term life insurance covers the insured for a specified period (e.g., 10, 20, or 30 years), whereas whole life insurance covers the insured for their entire lifetime.

Another significant difference lies in the cash value life insurance aspect of whole life policies. Term life insurance typically does not accumulate cash value, making whole life insurance a more comprehensive financial product for those seeking both a death benefit and a savings element.

Benefits and Considerations of Whole Life Insurance

Whole life insurance offers a range of benefits that can provide financial security and peace of mind for policyholders and their families.

Financial Advantages of Cash Value Accumulation

One of the significant benefits of whole life insurance is the cash value accumulation component. Over time, a portion of the premiums paid accumulates as cash value, which can be borrowed against or used to pay premiums.

The cash value grows at a guaranteed rate, providing a stable source of funds that can be used for various financial needs, such as supplementing retirement income or covering unexpected expenses.

- Tax-deferred growth: The cash value grows tax-deferred, meaning policyholders won’t pay taxes on the gains until they withdraw them.

- Loan options: Policyholders can take loans against the cash value, often at favorable interest rates.

- Supplemental income: The cash value can be used to supplement retirement income or cover financial emergencies.

Tax Benefits of Whole Life Policies

Whole life insurance policies also come with tax benefits that can be advantageous for policyholders. The death benefit is generally income-tax-free to beneficiaries, providing them with a tax-free financial safety net.

Additionally, the cash value accumulation grows tax-deferred, as mentioned earlier. This means that policyholders can accumulate wealth over time without having to pay taxes on the gains until they are withdrawn.

Who Should Consider Whole Life Insurance

Whole life insurance is not suitable for everyone, but it can be an excellent choice for certain individuals. The ideal candidates for whole life insurance are those who want lifelong coverage and are willing to pay higher premiums for the additional benefits.

Ideal Candidates for Whole Life Coverage

Some of the ideal candidates for whole life insurance include:

- Individuals with dependents who want to ensure their financial well-being even after they’re gone.

- Business owners who want to use whole life insurance as a tool for business succession planning or key person insurance.

- Those looking for a stable, long-term investment component as part of their financial portfolio.

When Other Insurance Types Might Be Better

While whole life insurance offers numerous benefits, there are situations where other types of insurance might be more suitable. For example, individuals on a tight budget might find term life insurance more affordable, providing them with the coverage they need at a lower cost.

Ultimately, the choice between whole life insurance and other types of insurance depends on individual circumstances, financial goals, and priorities.

Conclusion

Understanding whole life insurance definition is crucial for making informed decisions about your financial security. As discussed, whole life insurance provides a lifetime coverage with a cash value component that accumulates over time, offering a valuable financial tool for policyholders.

The key benefits of whole life insurance, including its permanent nature, cash value accumulation, and tax benefits, make it an attractive option for individuals seeking long-term financial protection. By grasping the whole life insurance definition and its core features, you can better assess whether this type of insurance aligns with your financial goals and needs.

Ultimately, whole life insurance can be a valuable component of a comprehensive financial plan, providing a safety net for loved ones and a potential source of funds during your lifetime. By considering your options carefully and seeking professional advice when needed, you can make the most of whole life insurance and secure a more stable financial future.

FAQ

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the insured’s entire lifetime, as long as premiums are paid. It also includes a cash value component that grows over time.

How does whole life insurance differ from term life insurance?

Whole life insurance differs from term life insurance in that it provides lifetime coverage, whereas term life insurance only covers the insured for a specified period. Whole life insurance also includes a cash value accumulation feature.

What are the benefits of the cash value accumulation in whole life insurance?

The cash value accumulation in whole life insurance provides a financial resource that can be borrowed against or used to pay premiums. It also grows tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them.

Are there any tax benefits associated with whole life insurance?

Yes, whole life insurance policies offer tax benefits, including tax-deferred growth of the cash value and a tax-free death benefit. However, it’s essential to consult with a tax professional to understand the specific tax implications of your policy.

Who is whole life insurance suitable for?

Whole life insurance is suitable for individuals who want lifetime coverage and a guaranteed death benefit, as well as a cash value component that can be used to supplement retirement income or pay for final expenses.

Can I borrow against the cash value of my whole life insurance policy?

Yes, you can borrow against the cash value of your whole life insurance policy. This can provide a source of funds for unexpected expenses or financial emergencies. However, borrowing against your policy can reduce the death benefit and cash value.

How do I determine if whole life insurance is right for me?

To determine if whole life insurance is right for you, consider your financial goals, income, expenses, and existing insurance coverage. It’s also a good idea to consult with a licensed insurance professional who can help you assess your needs and choose the best policy.