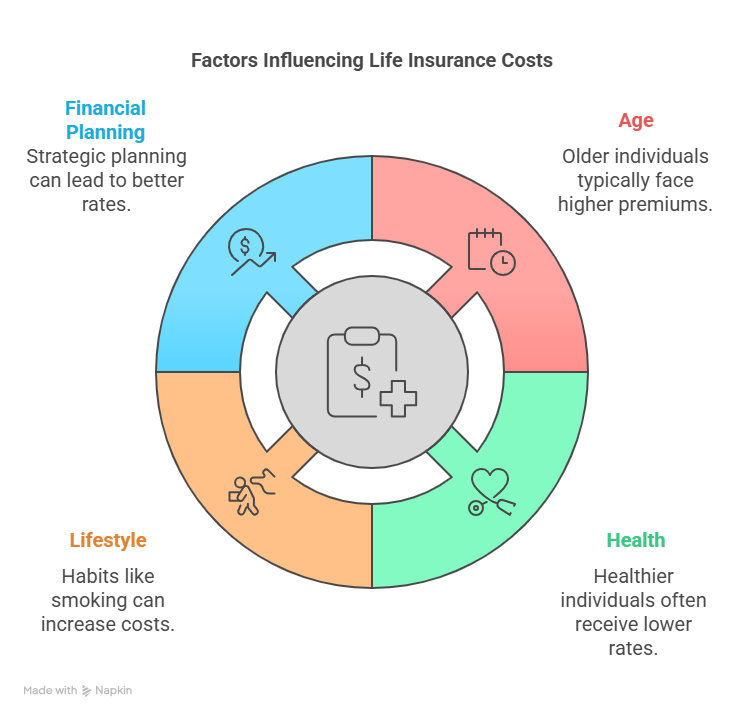

Understanding life insurance costs is crucial for effective financial planning. As we step into 2025, it’s essential to grasp what influences these costs and how they might impact your financial security.

The life insurance rates in 2025 are expected to be influenced by various factors, including age, health, and lifestyle choices. Being aware of these factors can help you make informed decisions about your life insurance coverage.

Knowing the expected costs can help you plan better and ensure that you and your loved ones are financially protected. As we explore the intricacies of life insurance costs, you’ll gain a clearer understanding of what to expect in 2025.

Key Takeaways

- Life insurance costs in 2025 will vary based on several factors.

- Understanding these factors can help you lower your rates.

- Age, health, and lifestyle are significant influencers of life insurance costs.

- Financial planning is crucial when considering life insurance.

- Being informed about life insurance rates can help you make better decisions.

Factors That Determine How Much Life Insurance Costs in 2025

Understanding the factors that determine life insurance costs in 2025 is crucial for making informed decisions. Several elements contribute to the final premium, and being aware of these can help you navigate the process more effectively.

Age and Health Considerations

Age and health are significant factors in determining life insurance costs. Generally, the younger and healthier you are, the lower your premiums will be.

Medical Exam Results and Their Impact

Medical exam results play a crucial role in assessing your health and determining your life insurance premiums. Insurers use these results to evaluate your risk level. For instance, favorable medical exam results can lead to lower premiums, while health issues may increase your costs.

Age-Based Premium Increases

As you age, your life insurance premiums typically increase. This is because older individuals are considered higher risk by insurers. The likelihood of health issues rises with age, making it essential to consider purchasing life insurance at a younger age to lock in lower rates.

Coverage Amount and Policy Length

The amount of coverage you choose and the length of your policy also significantly impact your life insurance costs. Higher coverage amounts and longer policy terms result in higher premiums. It’s essential to balance your coverage needs with your budget.

Lifestyle and Occupation Risk Factors

Your lifestyle and occupation can also affect your life insurance costs. For example, individuals with high-risk occupations or hobbies may face higher premiums due to the increased risk of injury or death. Insurers assess these risks when determining your premium.

| Factor | Low-Risk Scenario | High-Risk Scenario |

|---|---|---|

| Age | 30 years old | 60 years old |

| Health | No chronic conditions | History of serious health issues |

| Occupation | Office worker | High-risk profession (e.g., firefighter) |

| Premium Impact | Lower premiums | Higher premiums |

Average Life Insurance Rates for 2025

Understanding the average life insurance rates for 2025 is crucial for making informed decisions about your life insurance coverage. As we delve into the specifics, you’ll gain a clearer picture of what to expect when choosing a policy.

Term Life Insurance Costs by Age Group

Term life insurance rates vary significantly across different age groups. Generally, the younger you are, the lower your premiums will be. For instance, a healthy 30-year-old might pay around $30 per month for a 20-year term policy with a $500,000 coverage amount.

In contrast, a 50-year-old with the same coverage could pay upwards of $150 per month. This significant difference highlights the importance of purchasing life insurance at a younger age.

10, 20, and 30-Year Term Comparisons

When selecting a term life insurance policy, the length of the term is a critical factor. 10-year term policies are ideal for those who need coverage for a specific period, such as until their children are financially independent.

20-year term policies offer longer coverage and are often chosen by those with younger children or significant financial obligations. Meanwhile, 30-year term policies provide the longest coverage period, typically appealing to those who want to ensure their dependents are protected well into the future.

- A 10-year term policy might cost between $20 to $50 per month for a healthy 30-year-old.

- A 20-year term policy could range from $30 to $100 per month for the same demographic.

- A 30-year term policy may cost between $50 to $150 per month.

Whole Life and Universal Life Pricing

Whole life insurance and universal life insurance are permanent life insurance options that come with a cash value component. Whole life insurance provides a guaranteed death benefit and a cash value that grows at a fixed rate.

Universal life insurance, on the other hand, offers more flexibility in terms of premium payments and death benefits, but the cash value growth is often tied to the performance of underlying investments.

Premiums for whole life and universal life insurance are typically higher than those for term life insurance. For example, a whole life insurance policy for a 30-year-old might cost $200 to $500 per month, depending on the coverage amount and other factors.

No-Exam vs. Traditional Policy Costs

No-exam life insurance policies have gained popularity due to their convenience and faster application process. These policies often come with higher premiums compared to traditional life insurance policies that require a medical exam.

The cost difference is largely due to the insurer’s increased risk when not requiring a medical exam. However, for those with certain health conditions or a busy schedule, no-exam policies can be a viable and attractive option.

On average, no-exam life insurance policies might cost 20% to 50% more than traditional policies, depending on the insurer and the specific policy details.

Conclusion: Finding Affordable Life Insurance in 2025

Understanding the factors that influence life insurance costs is crucial in securing the right policy at a reasonable price. As discussed, age, health, coverage amount, and lifestyle all play a significant role in determining life insurance rates. To find affordable life insurance, it’s essential to assess your individual needs and circumstances.

By comparing different policy options and providers, you can identify the most cost-effective solution. For instance, term life insurance may be more affordable for younger individuals, while whole life insurance might be more suitable for those seeking lifetime coverage. Shopping around and taking advantage of no-exam policies can also help reduce costs.

Ultimately, securing affordable life insurance in 2025 requires careful consideration of your personal circumstances and a thorough understanding of the available options. By doing so, you can ensure that you and your loved ones are protected without breaking the bank. Look for insurance providers that offer competitive affordable life insurance rates and flexible policy terms to meet your needs.

FAQ

What are the main factors that influence life insurance costs in 2025?

The main factors that influence life insurance costs in 2025 include age, health, coverage amount, policy length, lifestyle, and occupation risk factors.

How does age affect life insurance costs?

Age significantly affects life insurance costs, with premiums typically increasing as you get older due to the higher risk of health issues.

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specified period, whereas whole life insurance covers you for your entire lifetime and often includes a cash value component.

How do medical exam results impact life insurance costs?

Medical exam results can significantly impact life insurance costs, as they help insurers assess your health risk and determine your premium rates.

Are no-exam life insurance policies more expensive?

No-exam life insurance policies can be more expensive than traditional policies, but they offer the convenience of not requiring a medical exam.

How does occupation affect life insurance costs?

Certain occupations that are considered high-risk, such as those involving hazardous materials or high-risk activities, may result in higher life insurance premiums.

Can lifestyle choices impact life insurance costs?

Yes, lifestyle choices such as smoking, engaging in high-risk hobbies, or participating in extreme sports can increase life insurance premiums.

What is the difference between universal life insurance and whole life insurance?

Universal life insurance offers flexible premiums and adjustable coverage, whereas whole life insurance typically has fixed premiums and a guaranteed death benefit.