Determining the right amount of life insurance coverage is crucial for ensuring that your loved ones are financially protected in the event of your unexpected passing.

Having adequate coverage can help cover funeral expenses, outstanding debts, and ongoing living costs, providing your family with the financial security they need during a difficult time.

Table of Contents

Figuring out how much life insurance you need can be challenging, but it’s a critical step in securing your family’s financial future.

Key Takeaways

- Assessing your financial obligations is key to determining life insurance needs.

- Consider factors like income, debts, and future expenses.

- Life insurance can provide financial security for your loved ones.

- Adequate coverage can help cover funeral expenses and outstanding debts.

- Reviewing and adjusting your coverage regularly is essential.

Understanding Life Insurance Coverage Fundamentals

Grasping the basics of life insurance coverage is crucial for making informed decisions about your financial security. Life insurance is designed to provide a financial safety net for your loved ones in the event of your passing. It can help cover funeral expenses, outstanding debts, and ongoing living costs, ensuring that your family remains financially stable.

Types of Life Insurance Policies Available

There are several types of life insurance policies available, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specified period, while whole life and universal life insurance offer lifetime coverage with a cash value component.

Common Coverage Amount Benchmarks

A common benchmark for determining life insurance coverage is to have a policy that equals 5-10 times your annual income. This can help ensure that your loved ones are financially supported in your absence.

| Annual Income | Recommended Coverage |

|---|---|

| $50,000 | $250,000 – $500,000 |

| $100,000 | $500,000 – $1,000,000 |

Signs You May Need More Coverage

If you have dependents, significant debts, or a mortgage, you may need to consider increasing your life insurance coverage.

https://www.youtube.com/watch?v=WQKo87NYSXAHaving adequate coverage can provide peace of mind and financial security for your loved ones.

How Much Life Insurance Do You Need? Calculating Your Ideal Coverage

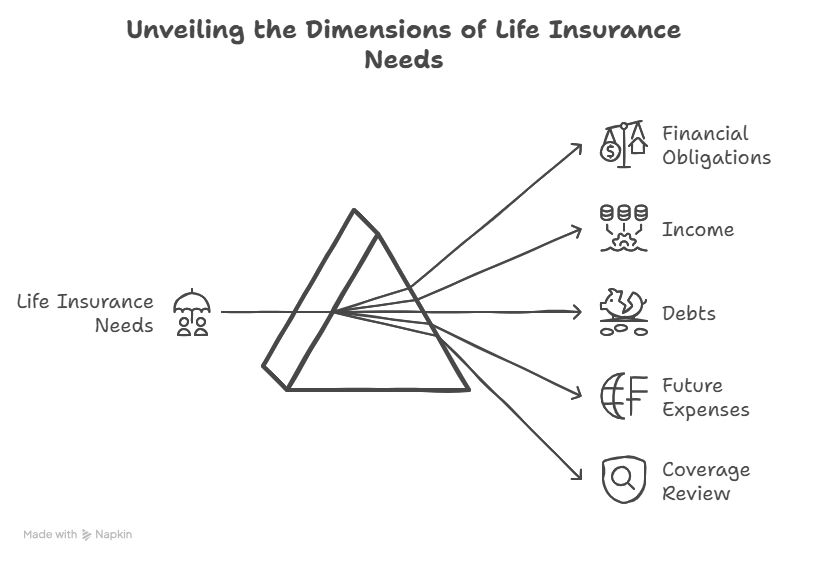

Calculating your ideal life insurance coverage requires understanding several key factors that influence your financial obligations and future goals. Life insurance is not a one-size-fits-all solution; it must be tailored to your individual circumstances.

Key Factors That Determine Your Coverage Requirements

Several factors play a crucial role in determining how much life insurance you need. Understanding these elements will help you make an informed decision.

Income and Financial Obligations

Your income and financial obligations, such as debts, mortgages, and other financial responsibilities, are critical in determining your coverage needs. You need to ensure that your life insurance can cover these expenses in the event of your passing.

Family Structure and Dependents

The size and needs of your family are significant factors. If you have dependents, such as children or a spouse who relies on your income, you’ll need more coverage to ensure their financial security.

Future Financial Goals

Your future financial goals, including saving for your children’s education or retirement, should also be considered when calculating your ideal coverage. Life insurance can play a vital role in achieving these goals.

Effective Calculation Methods

There are several methods to calculate your life insurance needs. Here are a few effective approaches:

Income Replacement Method

The income replacement method involves calculating how much income your family would need to maintain their standard of living if you were no longer around. This method considers your current income and the number of years your family would need financial support.

DIME Formula (Debt, Income, Mortgage, Education)

The DIME formula is a straightforward way to estimate your life insurance needs by adding up your debt, income, mortgage, and education expenses. This formula provides a comprehensive view of your financial obligations.

Human Life Value Approach

The human life value approach estimates the economic value of your life by considering your potential future earnings. This method helps in understanding the financial impact of your absence on your family’s future.

Using Online Life Insurance Calculators Effectively

Online life insurance calculators can be a valuable tool in determining your coverage needs. To use them effectively, you’ll need to input accurate information about your financial situation, including income, expenses, debts, and future goals. These calculators can provide a quick estimate, but it’s essential to review and adjust the results based on your individual circumstances.

Balancing Coverage Needs with Affordable Premiums

While determining your ideal coverage is crucial, it’s equally important to balance your needs with affordable premiums. You may need to adjust your coverage amount or policy features to ensure that your premiums fit within your budget. Using a life insurance premium calculator or comparing life insurance quotes online can help you find the best option.

Conclusion: Securing the Right Amount of Coverage for Your Loved Ones

Determining the right amount of life insurance coverage is crucial for ensuring your loved ones are financially protected. Understanding life insurance fundamentals and calculating your ideal coverage enables informed decisions.

Finding the best life insurance plans involves comparing policies and considering coverage amount, premium costs, and additional benefits. A life insurance comparison chart can simplify this process, helping you identify suitable options.

You can secure the right coverage for your loved ones by looking for insurers that offer affordable life insurance rates. This provides them with financial security and peace of mind. Evaluating different plans and rates is key to making the best choice.

FAQ

What is the best way to determine how much life insurance coverage I need?

To determine the right amount of life insurance coverage, consider factors such as your income, financial obligations, family structure, and future financial goals. You can use online life insurance calculators or consult with a financial advisor to find the ideal coverage amount for your situation.

How do I know if I need term life insurance or whole life insurance?

Term life insurance provides coverage for a specified period, while whole life insurance covers you for your entire lifetime. Consider your financial goals and needs: if you want coverage for a specific period, such as until your children are grown, term life might be suitable. For lifelong coverage and a cash value component, whole life insurance could be more appropriate.

Can I use a life insurance premium calculator to estimate my costs?

Yes, a life insurance premium calculator can help you estimate your premium costs based on factors like your age, health, coverage amount, and policy term. This tool can give you a rough idea of what to expect, but keep in mind that actual premiums may vary depending on the insurance provider and your individual circumstances.

What are some common life insurance policy options available?

Common life insurance policy options include term life, whole life, universal life, and variable life insurance. Each type has its unique features, benefits, and drawbacks. For example, term life is often more affordable, while whole life provides a cash value component. You can compare different policy options to find the best fit for your needs and budget.

How can I get affordable life insurance rates?

To get affordable life insurance rates, consider shopping around and comparing quotes from multiple insurance providers. You can also work on improving your health and credit score, as these factors can impact your premiums. Additionally, consider adjusting your coverage amount or policy features to fit within your budget.

What is the DIME formula, and how is it used to calculate life insurance coverage?

The DIME formula is a method used to estimate life insurance coverage needs by considering four key factors: Debt, Income, Mortgage, and Education expenses. By adding up these components, you can get an estimate of how much coverage you may need to protect your loved ones financially.

Can I adjust my life insurance coverage amount over time?

Yes, you can typically adjust your life insurance coverage amount as your needs change. For example, you may want to increase coverage if you have more dependents or decrease it if your financial obligations decrease. Review your policy regularly to ensure it remains aligned with your changing circumstances.