Determining the right life insurance coverage amount can be a daunting task. With so many factors to consider, it’s easy to feel overwhelmed.

Seeking advice from Reddit users and experts can provide valuable insights. They share their experiences and expertise, helping individuals make informed decisions about their life insurance needs.

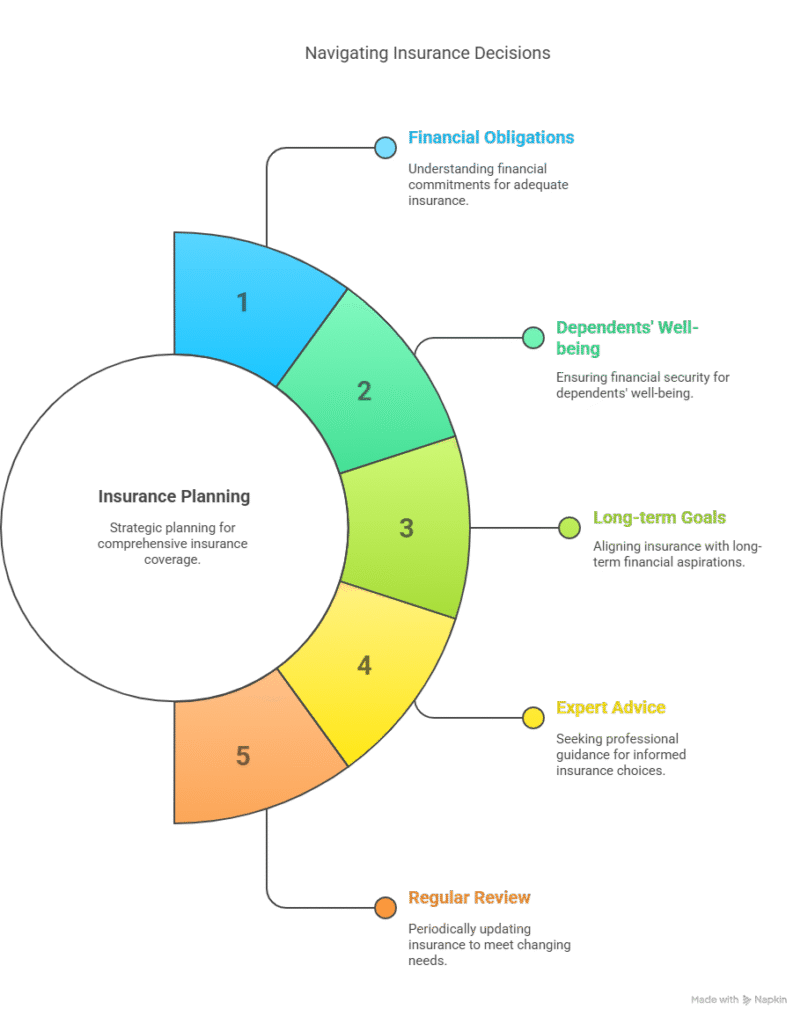

Determining life insurance needs requires careful consideration of various factors, including financial obligations, dependents, and long-term goals.

Key Takeaways

- Assess your financial obligations to determine coverage needs.

- Consider your dependents and their financial well-being.

- Evaluate your long-term financial goals.

- Seek advice from experts and online communities.

- Review and adjust your coverage regularly.

Common Life Insurance Formulas on Reddit

To simplify the process of determining life insurance needs, Reddit users frequently reference popular formulas. These formulas provide a starting point for calculating the appropriate amount of coverage.

The 10x Income Rule

A widely used rule of thumb is the 10x income rule, which suggests that you should have life insurance coverage equal to 10 times your annual income. For example, if you earn $50,000 per year, you should have $500,000 in coverage. This rule is simple but may not account for individual circumstances.

The DIME Method Explained

Another approach is the DIME method, which considers four key factors: Debt, Income, Mortgage, and Education expenses. By adding up these components, you can estimate how much life insurance you need. For instance, if you have $20,000 in debt, your income is $60,000, your mortgage is $200,000, and you expect to pay $100,000 for your child’s education, your total coverage would be $380,000 plus the income replacement needed.

Online Life Insurance Calculators

Many Reddit users also recommend using online life insurance calculators to determine coverage needs. These tools ask for detailed financial information and provide a more tailored estimate. You can find these calculators on various financial websites, and they often consider factors like age, income, expenses, and dependents.

| Method | Description | Example Coverage |

|---|---|---|

| 10x Income Rule | Coverage equals 10 times annual income | $500,000 (for $50,000 income) |

| DIME Method | Sum of Debt, Income, Mortgage, Education expenses | $380,000 (plus income replacement) |

| Online Calculators | Detailed financial information for tailored estimate | Varies based on input |

How Much Life Insurance Do I Need? Reddit Users Share Their Experiences

Reddit users have shared their diverse experiences and insights on determining the right life insurance coverage. The platform serves as a valuable resource for understanding different approaches to life insurance decisions.

Young Families’ Coverage Decisions

Young families on Reddit often discuss their struggles with balancing life insurance costs and coverage needs. Many recommend considering the number of dependents and future expenses, such as education costs, when deciding on coverage.

Mid-Career Professionals’ Approaches

Mid-career professionals share their strategies for adjusting life insurance coverage as their financial situations change. They often suggest reassessing coverage during major life events, like promotions or children leaving home.

Special Circumstances Discussed in Reddit Forums

Reddit forums also cover special circumstances, such as having a high-risk profession or health issues, and how these factors impact life insurance needs. Users recommend seeking advice from financial advisors for personalized guidance.

Expert Analysis of Reddit’s Life Insurance Advice

Analyzing Reddit’s life insurance advice through an expert lens reveals key takeaways and areas for caution. The platform’s diverse community offers a wide range of perspectives on determining life insurance needs, from simple rules of thumb to complex financial planning strategies.

Where Reddit Gets It Right

Many Reddit users correctly emphasize the importance of considering personal circumstances when calculating life insurance coverage amount. For instance, young families often require more extensive coverage to secure their dependents’ financial futures.

Experienced users also highlight the need to regularly review and adjust coverage as life circumstances change, ensuring that the policy remains relevant and effective.

Common Misconceptions Found on Reddit

Despite the valuable insights, there are also misconceptions. Some users oversimplify the process, suggesting that a one-size-fits-all approach, such as the “10x income rule,” is sufficient for everyone. Experts caution that this method may not account for individual factors like debt, dependents, and long-term financial goals.

Critical Factors for Determining Coverage Needs

Experts agree that how much life insurance do I need Reddit is a complex question that depends on multiple factors, including income, expenses, debts, and future financial obligations. A thorough assessment of these elements is crucial for determining the appropriate life insurance coverage amount.

By considering these critical factors and learning from both the strengths and weaknesses of Reddit’s advice, individuals can make more informed decisions about their life insurance needs.

Conclusion: Finding Your Ideal Life Insurance Coverage Amount

Determining the right life insurance coverage is a personal decision that depends on various factors, including income, expenses, debts, and future obligations. By considering the insights shared by Reddit users and expert analysis, you can make an informed decision that suits your unique circumstances.

Utilizing an online life insurance estimator or life insurance calculator can provide a good starting point for estimating your coverage needs. However, it’s essential to consider your individual circumstances and adjust your coverage accordingly.

Ultimately, the goal is to secure life insurance coverage recommendations that protect your loved ones and provide peace of mind. By taking the time to assess your needs and explore your options, you can find the ideal coverage amount that aligns with your financial goals and objectives.

FAQ

How do I determine the right amount of life insurance coverage for my needs?

To determine the right amount of life insurance coverage, consider factors such as income, expenses, debts, and financial goals. You can use online life insurance calculators or consult with a financial advisor to get a personalized estimate. Reddit users often recommend considering the 10x income rule or the DIME method as a starting point.

What is the 10x income rule, and is it a reliable method for calculating life insurance needs?

The 10x income rule suggests that you should have life insurance coverage equal to 10 times your annual income. While this rule can provide a rough estimate, it may not be suitable for everyone, as individual circumstances vary. Reddit users and experts agree that it’s essential to consider other factors, such as expenses and debts, to determine the right coverage amount.

How does the DIME method work, and what does it consider?

The DIME method is a formula that calculates life insurance needs based on four factors: Debt, Income, Mortgage, and Education expenses. It provides a more comprehensive estimate than the 10x income rule, as it takes into account specific financial obligations. Reddit users and financial experts recommend using the DIME method as a more accurate way to determine life insurance coverage needs.

Can online life insurance calculators provide an accurate estimate of my life insurance needs?

Online life insurance calculators can provide a good starting point for estimating life insurance needs. However, their accuracy depends on the information you input, and they may not consider all the factors that are relevant to your specific situation. Reddit users suggest using online calculators as a rough guide and then consulting with a financial advisor for a more personalized assessment.

How often should I review and update my life insurance coverage?

It’s essential to review and update your life insurance coverage regularly, especially when significant life events occur, such as having children, getting married, or changing jobs. Reddit users and experts recommend reviewing your coverage every few years to ensure it remains aligned with your changing needs and financial situation.

What are some common misconceptions about life insurance that I’ve seen on Reddit?

Some common misconceptions about life insurance include the idea that it’s only necessary for breadwinners or that it’s too expensive. Reddit users and experts agree that life insurance is essential for anyone with dependents, and that there are affordable options available. They also caution against underestimating the importance of considering other types of insurance, such as disability insurance, in conjunction with life insurance.