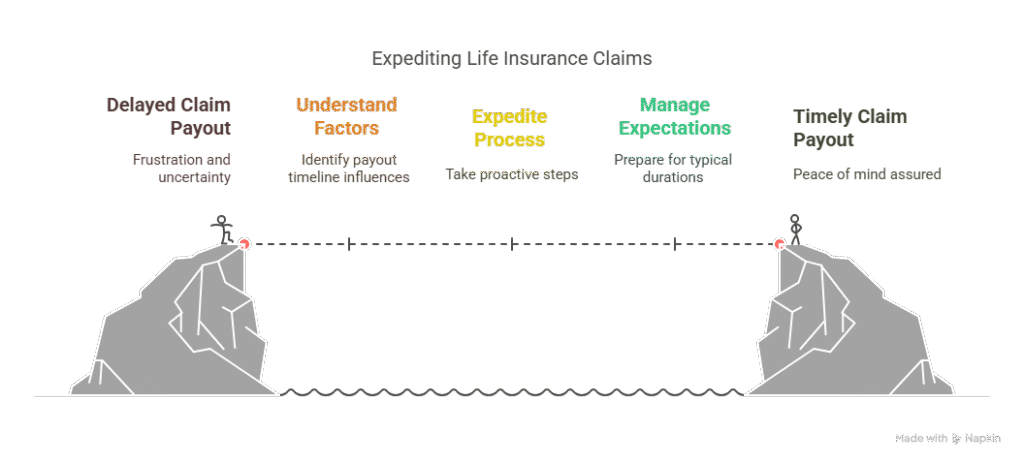

Receiving a life insurance payout can be a crucial financial lifeline for beneficiaries dealing with the loss of a loved one. The process and timeline for receiving this payout can vary, often leaving beneficiaries wondering about the duration of the life insurance claim duration.

Understanding the factors that influence the payout timeline can help manage expectations and reduce stress during a difficult time. This article will guide you through the typical process and timeline for life insurance payouts, providing clarity on what to expect.

Key Takeaways

- Factors influencing life insurance payout timelines

- Typical duration for processing life insurance claims

- Steps to expedite the life insurance claim process

- Common reasons for delays in life insurance payouts

- Tips for beneficiaries to manage their expectations

The Typical Life Insurance Payout Timeline

Beneficiaries often wonder how long it takes to receive life insurance benefits. The life insurance payout timeline can vary based on several factors, including the insurance company’s processing efficiency and the complexity of the claim.

Average Processing Times

The average processing time for life insurance payouts typically ranges from a few weeks to a couple of months. Most insurance companies aim to settle claims within 30 to 60 days after receiving the necessary documentation.

Payment Methods and Options

Beneficiaries can usually choose from various payment methods, such as lump-sum payments or installment plans. The chosen payment method can affect the overall payout timeline.

Expedited Payment Possibilities

In some cases, expedited payments are possible, especially for policies with a clear beneficiary designation and minimal contestability. Insurance companies may offer accelerated payout options for an additional fee.

How Long Life Insurance Payout Process Works

Understanding the life insurance payout process can help beneficiaries prepare for what’s ahead. The journey to receiving a life insurance payout involves several critical steps, each with its own timeline and requirements.

Filing the Initial Death Claim

The first step in the life insurance payout process is filing the initial death claim. This involves notifying the insurance company of the policyholder’s passing and initiating the claim process. Beneficiaries can typically do this by contacting the insurance company’s claims department directly or by using the company’s online claims portal. It’s essential to have the policy number and a death certificate ready to expedite the process.

Required Documentation and Paperwork

To process the claim, insurance companies require specific documentation, including:

- A certified copy of the death certificate

- The original life insurance policy or a copy of the policy documents

- Claimant’s identification and proof of insurable interest

- Any additional forms required by the insurance company

Ensuring that all required documents are submitted accurately and promptly can significantly impact the life insurance claim settlement period.

Claim Review and Verification Steps

Once the initial claim and required documentation are submitted, the insurance company reviews and verifies the information. This step is crucial in determining the validity of the claim and ensuring that all policy conditions are met. The duration for life insurance payout can be influenced by how efficiently this step is completed.

During this phase, the insurance company may contact beneficiaries for additional information or clarification. Responding promptly to these requests can help avoid delays in the payout process.

Factors That Can Delay Your Life Insurance Payout

After a policyholder’s death, beneficiaries often face a waiting period before receiving the life insurance payout, which can be prolonged by certain factors. Understanding these potential delays can help manage expectations and prepare for the process ahead.

Cause of Death Investigations

In cases where the cause of death is unclear or under investigation, life insurance companies may delay payout until the investigation is concluded. This is a standard procedure to ensure that the death is not due to an excluded cause as per the policy terms. Investigations can take time, and until they are resolved, the insurance company may not process the claim.

Policy Age and Contestability Period

If the policy is within its contestability period, typically the first two years, the insurer may scrutinize the claim more thoroughly. This period is crucial as insurers look for any misrepresentation or concealment on the application that could affect the payout. If discrepancies are found, it could lead to delays or even denial of the claim.

Missing or Incomplete Documentation

Beneficiaries must provide all required documentation for the claim to be processed. Missing or incomplete documents can significantly delay the life insurance payout. It’s essential to submit all necessary paperwork promptly to avoid unnecessary delays.

Legal Disputes Among Beneficiaries

Legal disputes among beneficiaries or between beneficiaries and the estate can complicate and delay the payout process. In such cases, the insurance company may hold the payout until the dispute is resolved through legal channels. Here is a list of common issues that can lead to disputes:

- Disagreements over the beneficiary designation

- Contests over the validity of the will

- Disputes among multiple beneficiaries

Being aware of these potential issues can help beneficiaries navigate the process more smoothly.

Conclusion: Ensuring a Smooth and Timely Payout

Understanding the life insurance payout process is crucial for beneficiaries to receive their claims efficiently. The life insurance claim approval timeframe can vary depending on several factors, including the cause of death, policy terms, and documentation.

To ensure a smooth payout, it’s essential to file the initial death claim promptly and provide all required documentation. Beneficiaries should also be aware of potential delays, such as investigations into the cause of death or disputes among beneficiaries.

By being informed and prepared, beneficiaries can navigate the process more effectively, ultimately receiving their payout in a timely manner. Insurance companies like Prudential and MetLife have streamlined their processes to facilitate faster claim approvals, making it easier for beneficiaries to access the funds they need during a difficult time.

FAQ

How long does it typically take for a life insurance company to pay out a claim?

The average life insurance payout processing time can range from a few weeks to a few months, depending on the complexity of the claim and the insurance company’s efficiency.

What factors can influence the life insurance claim settlement period?

Factors such as the cause of death, policy age, and completeness of documentation can impact the duration for life insurance payout, potentially leading to delays or expedited processing.

Can I expect a faster life insurance payout if I choose a specific payment method?

Some insurance companies offer expedited payment options, such as direct deposit or electronic funds transfer, which can result in a faster life insurance payment time.

How can I ensure a smooth and timely life insurance claim approval?

To minimize delays, it’s essential to provide complete and accurate documentation, respond promptly to insurance company requests, and ensure that the claim is filed correctly, which can help streamline the life insurance claim processing time.

What happens if there are disputes among beneficiaries, and how does it affect the payout timeline?

In cases where there are legal disputes among beneficiaries, the life insurance payout may be delayed until the issue is resolved, potentially prolonging the life insurance claim settlement period.

Are there any circumstances under which a life insurance company can deny or delay a claim?

Yes, life insurance companies may deny or delay claims due to various reasons, including cause of death investigations, policy contestability, or missing documentation, which can impact the life insurance benefit processing time.

How can I track the status of my life insurance claim?

You can typically track the status of your life insurance claim by contacting the insurance company’s claims department directly, who can provide updates on the life insurance claim processing time and any additional requirements.