Life insurance firms operate on a multifaceted business model that goes beyond just collecting premiums. They invest these premiums and manage risk to generate revenue. Understanding this complex process is crucial to grasping the overall framework of their business.

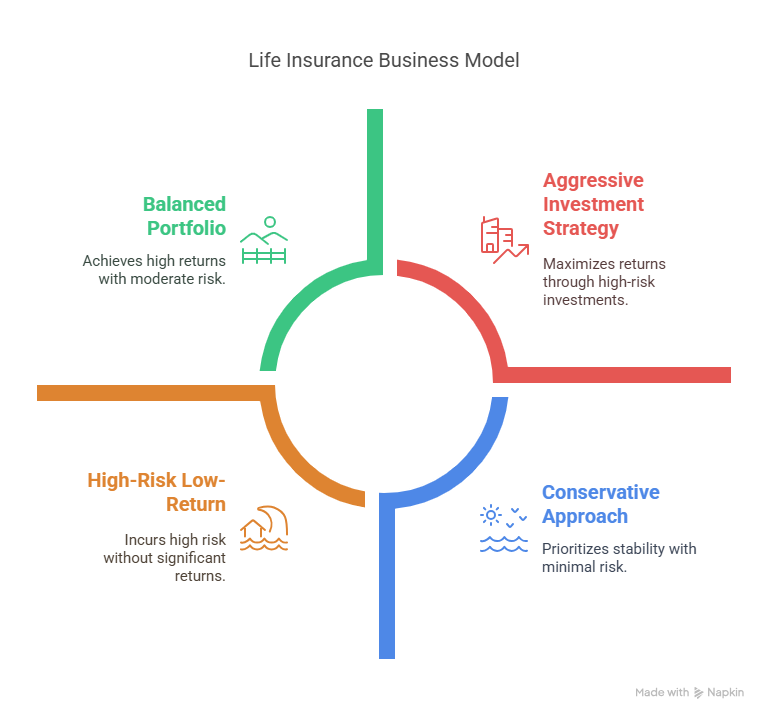

The revenue generation of life insurance companies is rooted in their ability to balance risk and investment returns. By pooling premiums from a large customer base, they can invest in various assets, generating income through returns on these investments.

This intricate balance between risk management and investment is key to their profitability. In the following sections, we will delve deeper into the specifics of their business model, exploring the various strategies they employ to maintain profitability.

Key Takeaways

- Life insurance companies generate revenue through a combination of premium collection, investment, and risk management.

- Their business model is complex, involving the pooling of premiums and investment in various assets.

- Investment returns play a crucial role in their revenue generation.

- Risk management is essential to maintaining profitability.

- The balance between risk and investment returns is key to their business model.

How Life Insurance Companies Make Money: The Core Business Model

At the heart of life insurance companies’ profitability lies a dual mechanism that involves both the collection of premiums and strategic investment decisions. This core business model is fundamental to understanding how these companies generate revenue.

Premium Collection and Investment Strategy

Life insurance companies collect premiums from policyholders, which are then invested in a variety of assets to generate returns. The investment strategy is crucial as it directly impacts the company’s ability to pay out claims and maintain profitability. Common investment avenues include:

- Bonds: Government and corporate bonds offer a relatively stable source of returns.

- Stocks: Investments in the stock market can provide higher returns, though they come with greater risk.

- Real Estate: Investing in property can offer both rental income and potential long-term appreciation in value.

The Power of Underwriting and Risk Assessment

The underwriting process is critical in determining policy premiums and ensuring the company’s profitability. By assessing the risk associated with insuring a client, underwriters can set premiums that balance competitiveness with the need to cover potential claims. Effective risk assessment involves:

- Evaluating the client’s health, lifestyle, and other risk factors.

- Using actuarial tables and statistical models to predict life expectancy and potential claims.

- Adjusting premiums accordingly to reflect the assessed risk.

This balanced approach enables life insurance companies to manage their risk exposure while providing valuable coverage to their clients.

Revenue Streams Beyond Premiums

Beyond premium payments, life insurance providers have developed multiple income streams to sustain their business model. These additional revenue sources not only enhance profitability but also contribute to the overall financial stability of the insurance companies.

Policy Lapses and Surrenders

When policyholders allow their policies to lapse or surrender their policies early, insurance companies can retain a portion of the premiums paid without having to pay out the full benefit. This retained amount contributes to the insurer’s revenue. Policy lapses and surrenders are a significant aspect of the insurance business, as they directly impact the company’s bottom line.

Administrative Fees and Charges

Life insurance companies often levy administrative fees and charges on policyholders. These fees can be for services such as policy administration, late payment charges, or other services related to the policy. These charges add to the revenue of the insurance company, enhancing their income streams.

Cash Value Products and Interest Margins

Cash value life insurance products allow insurers to earn interest margins. When policyholders pay premiums, a portion of it is invested by the insurer. The difference between the interest earned on these investments and the interest credited to the policyholder’s account is the interest margin, which serves as another revenue stream.

Reinsurance Arrangements

Reinsurance is a critical risk management strategy used by life insurance companies. By reinsuring certain policies, insurers can manage their risk exposure and free up capital to underwrite more policies. Reinsurance arrangements not only help in managing risk but also contribute to the revenue through reinsurance premiums and profit-sharing agreements.

In conclusion, life insurance companies diversify their revenue through various channels beyond premium collection. Understanding these profit models in the life insurance industry provides insight into how insurers maintain profitability while offering valuable protection to their policyholders.

Conclusion: The Balancing Act of Profitability and Customer Value

Life insurance companies operate in a delicate balance between pursuing profitability and providing value to their customers. The core business model, centered around premium collection and investment strategy, underwriting, and risk assessment, generates significant revenue. Additional revenue streams come from policy lapses and surrenders, administrative fees, cash value products, and reinsurance arrangements, all contributing to the earning potential for life insurance companies.

To maintain profitability, life insurance companies must navigate the complexities of the industry while ensuring they offer competitive products that meet policyholders’ needs. The profitability of the life insurance sector is thus tied to both the companies’ ability to manage risk and their capacity to provide value to customers. By understanding these dynamics, it becomes clear how life insurance companies sustain themselves financially while serving their policyholders.

FAQ

How do life insurance companies primarily make money?

Life insurance companies primarily make money through premium collection and investment strategies. They collect premiums from policyholders and invest them in various assets to generate returns.

What is underwriting, and how does it impact life insurance companies’ profitability?

Underwriting is the process of assessing the risk of insuring a client, which directly impacts the premium charged. Accurate underwriting ensures that life insurance companies can manage their risk exposure and maintain profitability.

How do policy lapses and surrenders benefit life insurance companies?

When policies lapse or are surrendered, life insurance companies often retain a portion of the premiums paid without having to pay out the full benefit, resulting in a financial gain.

What are administrative fees and charges in the context of life insurance?

Administrative fees and charges are additional revenue streams for life insurance companies, covering the costs of managing policies, processing claims, and other operational expenses.

How do cash value products contribute to life insurance companies’ revenue?

Cash value products allow life insurance companies to earn interest margins, as they invest the cash value component of these policies and earn returns on the invested funds.

What is reinsurance, and how does it impact life insurance companies’ financials?

Reinsurance is a risk management strategy where life insurance companies reinsure certain policies with other insurers, transferring some of the risk and potential losses, and thereby managing their overall risk exposure.

How do life insurance companies balance profitability with customer value?

Life insurance companies strive to balance their pursuit of profitability with the need to provide competitive products and services that meet the needs of their policyholders, ensuring they remain financially sustainable while delivering value to customers.

What are the key factors that influence life insurance companies’ earning potential?

The key factors influencing life insurance companies’ earning potential include their investment strategies, underwriting practices, policyholder behavior, and the overall economic environment.

How do interest rates affect life insurance companies’ profitability?

Interest rates can significantly impact life insurance companies’ profitability, as changes in interest rates can affect the returns on their investments and the attractiveness of their products to policyholders.