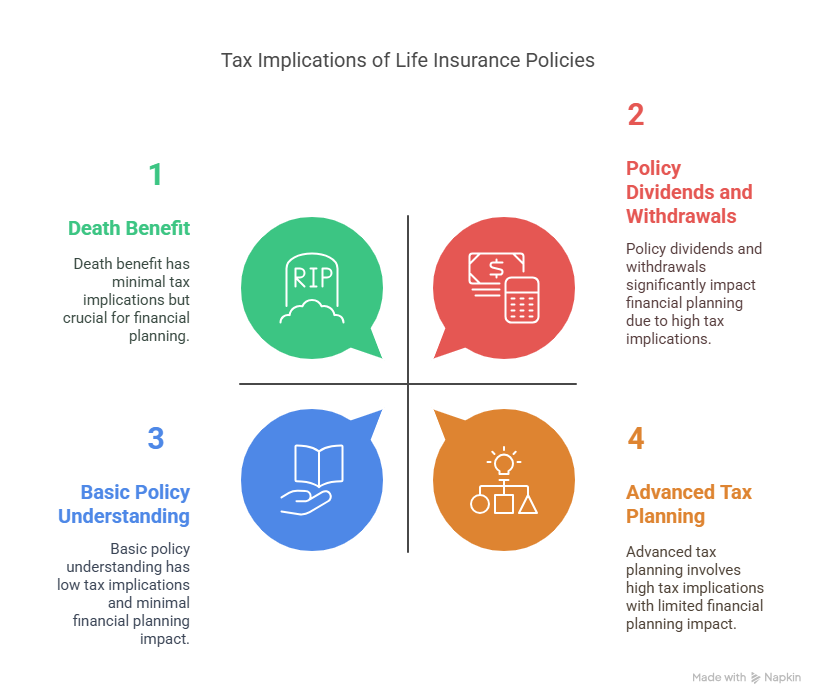

As we navigate the complexities of financial planning, understanding the tax implications of life insurance policies is crucial. In 2025, it’s essential to know how these policies are treated under tax laws to make informed decisions.

The tax treatment of life insurance proceeds and policies can be intricate, involving various rules and exemptions. Generally, the death benefit received by beneficiaries is not considered taxable income. However, other aspects, such as policy dividends or withdrawals, may have tax implications.

Being aware of these rules can help policyholders and beneficiaries avoid unexpected tax liabilities and make the most of their insurance investments.

Key Takeaways

- Understanding the tax implications of life insurance policies is vital for financial planning.

- The death benefit from a life insurance policy is generally not taxable.

- Policy dividends and withdrawals may have tax implications.

- Awareness of tax rules can help avoid unexpected liabilities.

- Proper planning can maximize the benefits of life insurance investments.

Understanding Life Insurance Taxation Basics

Navigating the complexities of life insurance taxation can be challenging, but understanding the basics is crucial. Life insurance policies are designed to provide financial security to beneficiaries in the event of the policyholder’s death. However, the tax implications of these policies can be complex and vary depending on the type of policy.

Types of Life Insurance Policies and Their Tax Treatment

There are primarily two types of life insurance policies: term life insurance and permanent life insurance. Each has different tax implications that policyholders should understand.

Term Life Insurance Tax Implications

Term life insurance provides coverage for a specified period. Generally, term life insurance premiums are not tax-deductible, and the death benefit paid to beneficiaries is usually tax-free. However, there are exceptions, such as when the policy is transferred or assigned to another party.

Permanent Life Insurance Tax Considerations

Permanent life insurance, which includes whole life and universal life insurance, has a cash value component that grows over time. The cash value growth is tax-deferred, meaning policyholders won’t pay taxes on the gains until they withdraw them. Policyholders can borrow against the cash value, but outstanding loans can reduce the death benefit.

The General Tax-Free Status of Death Benefits

One of the primary benefits of life insurance is that the death benefit is generally income tax-free to beneficiaries. This means that beneficiaries receive the full benefit without having to pay federal income tax on it. However, there are some exceptions and considerations, such as:

- Estate taxes may apply if the policyholder’s estate exceeds the federal estate tax exemption.

- If the policy is transferred or assigned to another party, it may trigger tax implications.

- Interest earned on the death benefit, if left with the insurance company, may be taxable.

Can Life Insurance Be Taxed? Exceptions to Know

While life insurance proceeds are generally tax-free, there are specific exceptions to be aware of in 2025. Understanding these exceptions is crucial for policyholders to navigate the complex tax landscape surrounding life insurance.

Estate Tax Considerations for Large Policies in 2025

Large life insurance policies can have significant estate tax implications. The estate tax exemption amount is a critical factor in determining whether a policy will be subject to estate tax.

Current Estate Tax Exemption Amounts

As of 2024, the estate tax exemption amount is $13.61 million per individual. This means that estates valued below this threshold are not subject to federal estate tax.

Key Points to Consider:

- The exemption amount is subject to change, and it’s essential to stay informed about the current exemption amounts.

- Estate tax rates can be substantial, with a maximum rate of 40%.

Projected Changes for 2025

There are potential changes to the estate tax exemption amount in 2025. Policyholders should be aware of these potential changes to plan accordingly.

It’s crucial to consult with a tax professional to understand the implications of these changes on your specific situation.

The Three-Year Rule for Policy Transfers

The three-year rule is an important consideration when transferring life insurance policies. If a policy is transferred within three years of the policyholder’s death, the proceeds may be included in the estate for tax purposes.

To avoid this, policyholders can:

- Transfer the policy more than three years before their death.

- Use an irrevocable life insurance trust (ILIT) to hold the policy.

Taxation of Cash Value Withdrawals and Loans

Withdrawals and loans from the cash value of a life insurance policy can have tax implications. Generally, withdrawals are tax-free up to the policy’s basis, while loans are tax-free if the policy remains in force.

Key Considerations:

- Excess withdrawals may be subject to taxation.

- Policy loans can reduce the policy’s death benefit if not repaid.

Key Tax Exemptions and Strategies for Life Insurance in 2025

As we navigate the complexities of life insurance in 2025, it’s essential to understand the key tax exemptions and strategies that can benefit policyholders. Life insurance policies are not just about providing a death benefit; they can also be valuable financial tools that offer tax advantages.

Maximizing tax exemptions requires a thorough understanding of the available options. One effective strategy involves utilizing Irrevocable Life Insurance Trusts (ILITs), which can help minimize estate taxes and ensure that the death benefit is not subject to income tax.

Irrevocable Life Insurance Trusts (ILITs)

An ILIT is a trust that holds a life insurance policy, and its primary purpose is to keep the policy’s proceeds out of the insured’s estate, thereby reducing estate taxes. By transferring ownership of the policy to the ILIT, the grantor can ensure that the death benefit is not included in their taxable estate.

To set up an ILIT effectively, it’s crucial to follow the three-year rule, which states that the grantor must survive for at least three years after transferring the policy to the trust. If the grantor dies within this period, the proceeds will still be included in their estate for tax purposes.

Life Insurance as Part of Estate Planning

Life insurance can play a pivotal role in estate planning by providing liquidity to pay estate taxes, ensuring that heirs receive their inheritance without having to sell assets. By incorporating life insurance into an estate plan, individuals can minimize tax liabilities and ensure that their estate is distributed according to their wishes.

- Life insurance proceeds can be used to pay estate taxes, thereby preserving the estate’s assets.

- By keeping life insurance policies out of the estate, individuals can reduce their estate’s tax liability.

Tax-Free Policy Exchanges Under Section 1035

Another valuable strategy for life insurance policyholders is to take advantage of tax-free exchanges under Section 1035 of the Internal Revenue Code. This provision allows policyholders to exchange an existing life insurance policy for a new one without incurring tax liabilities on the cash value accumulated in the original policy.

To qualify for a tax-free exchange, the new policy must be issued by the same or a different insurance company, and the policyholder must not receive any cash or other consideration during the exchange process. By leveraging Section 1035 exchanges, policyholders can adjust their coverage and investment options without facing tax penalties.

Conclusion

Understanding the tax implications of life insurance is crucial for effective financial planning in 2025. As discussed, life insurance policies have various tax treatments depending on their type and other factors. Generally, death benefits are tax-free, but exceptions such as estate tax considerations and the taxation of cash value withdrawals and loans can apply.

To navigate these complexities, strategies like Irrevocable Life Insurance Trusts (ILITs) and tax-free policy exchanges under Section 1035 can be employed. Being aware of life insurance tax implications and leveraging these strategies can help minimize tax liabilities, ensuring that life insurance serves its intended purpose without unforeseen tax burdens.

By grasping the nuances of life insurance and taxes, individuals can make informed decisions that align with their financial goals and obligations, ultimately securing a more stable financial future.

FAQ

Is life insurance taxable?

Generally, life insurance death benefits are not subject to income tax. However, there may be exceptions, such as when the policy is considered part of the estate or when there are withdrawals or loans against the policy’s cash value.

Can life insurance proceeds be taxed?

Life insurance proceeds paid out as a death benefit are typically not taxable as income to the beneficiary. However, if the policy has a cash value component and withdrawals or loans are made, these may be subject to tax under certain conditions.

What are the tax implications of term life insurance?

Term life insurance typically does not have tax implications since it does not accumulate a cash value. The premiums paid are not deductible, and the death benefit is generally not taxable to the beneficiary.

How are permanent life insurance policies taxed?

Permanent life insurance policies, such as whole life or universal life, have a cash value component that grows over time. While the death benefit is generally not taxable, withdrawals or loans against the cash value may be subject to tax if they exceed the total premiums paid.

What is the three-year rule for life insurance policy transfers?

The three-year rule states that if a life insurance policy is transferred to another party and the insured dies within three years of the transfer, the death benefit will be included in the insured’s estate for estate tax purposes.

Are life insurance death benefits subject to estate tax?

Life insurance death benefits can be subject to estate tax if the policy is owned by the insured or if the insured has incidents of ownership. However, proper planning, such as using an Irrevocable Life Insurance Trust (ILIT), can help minimize or avoid estate tax.

Can I avoid taxes on my life insurance policy?

While life insurance death benefits are generally not taxable, strategies like using an ILIT or exchanging policies under Section 1035 can help minimize tax liabilities. It’s essential to consult with a tax professional to understand the best approach for your situation.

How do cash value withdrawals and loans affect life insurance taxation?

Withdrawals and loans against the cash value of a life insurance policy can have tax implications. Generally, withdrawals are tax-free up to the amount of premiums paid, but loans may be taxable if the policy lapses or is surrendered.

What is the role of Irrevocable Life Insurance Trusts (ILITs) in life insurance taxation?

ILITs are used to own life insurance policies, keeping the death benefit out of the insured’s estate and thus avoiding estate tax. ILITs can provide tax benefits and ensure that the death benefit is used according to the insured’s wishes.

Are tax-free policy exchanges possible under life insurance taxation rules?

Yes, tax-free policy exchanges are possible under Section 1035 of the tax code, allowing policyholders to exchange an existing life insurance policy for a new one without incurring tax on the gain.