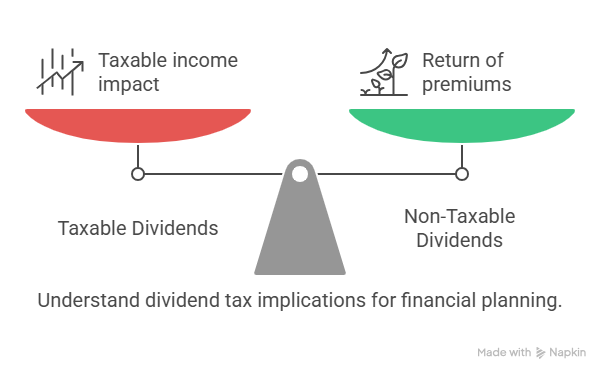

Receiving dividends from a life insurance policy can be a welcome surprise, but it’s natural to wonder about their tax implications. As a policyholder, understanding whether these dividends are taxable is crucial for managing your finances effectively.

The tax treatment of insurance dividends depends on several factors, including the type of policy and how the dividends are used. Generally, dividends received from a life insurance policy are considered a return of premiums rather than income, but there are exceptions.

Key Takeaways

- Life insurance dividends are generally not taxable if they are a return of premiums.

- The tax implications can vary based on the policy type and dividend usage.

- Understanding the tax status of dividends is crucial for financial planning.

- Policyholders should consult their insurance provider for specific guidance.

- Tax laws and regulations regarding insurance dividends can change.

Understanding Life Insurance Dividends

To grasp the tax implications of life insurance dividends, it’s essential to understand what they are and how they work. Life insurance dividends are payments made by insurance companies to their policyholders, typically those holding participating policies.

What Are Life Insurance Dividends?

Life insurance dividends are portions of the insurance company’s surplus that are distributed back to policyholders. They are not guaranteed and depend on the insurer’s financial performance. Dividends are primarily paid to policyholders who own participating life insurance policies, which allow them to share in the company’s profits.

How Dividends Are Generated

Dividends are generated from the surplus funds of the insurance company, which come from several sources:

- Mortality gains (when actual deaths are fewer than expected)

- Investment earnings that exceed expectations

- Operating expenses that are lower than anticipated

These surplus funds are then distributed to policyholders in the form of dividends.

Types of Dividend-Paying Policies

Not all life insurance policies pay dividends. Typically, participating whole life insurance policies and some universal life insurance policies are eligible to receive dividends. The type of policy and the insurance company determines whether a policyholder can receive dividends.

By understanding the basics of life insurance dividends, we can better navigate the complexities of their tax treatment, which will be discussed in the following sections.

Are Life Insurance Dividends Taxable?

Understanding whether life insurance dividends are taxable is crucial for policyholders to manage their financial obligations effectively. Life insurance dividends are payments made by the insurance company to policyholders, typically when the company performs better than expected financially.

The Return of Premium Principle

Generally, life insurance dividends are considered a return of premium rather than income. This principle is fundamental in understanding their tax implications. Since dividends are viewed as a refund of a part of the premiums paid, they are usually not subject to income tax.

IRS Treatment of Life Insurance Dividends

The IRS typically does not tax life insurance dividends if they do not exceed the total premiums paid by the policyholder. This aligns with the return of premium principle. However, certain conditions can change this treatment.

When Dividends Become Taxable

Dividends become taxable if they exceed the total premiums paid. Any amount received beyond the total premiums is considered taxable income. Additionally, interest earned on accumulated dividends is also taxable.

Tax Implications of Different Dividend Options

The way dividends are utilized can affect their tax implications. Here are some common dividend options and their tax considerations:

Cash Payments

When dividends are received as cash, they are generally not taxable unless they exceed the total premiums paid. Any interest earned on these payments is taxable.

Premium Reductions

Using dividends to reduce premiums is not considered taxable income since it’s viewed as a reduction in the premium cost rather than a gain.

Accumulated Dividends

Interest earned on accumulated dividends is taxable. The dividends themselves are not taxable unless the total amount exceeds the premiums paid.

Paid-Up Additions

Using dividends to purchase additional insurance (paid-up additions) is generally not taxable. The cost of this additional coverage is considered a premium payment.

| Dividend Option | Tax Implication |

|---|---|

| Cash Payments | Not taxable unless exceeding total premiums paid; interest earned is taxable |

| Premium Reductions | Not considered taxable income |

| Accumulated Dividends | Interest earned is taxable; dividends not taxable unless exceeding premiums paid |

| Paid-Up Additions | Generally not taxable |

Reporting Requirements for Taxable Dividends

Policyholders must report taxable dividends on their tax returns. Insurance companies typically provide policyholders with the necessary information on taxable dividends through Form 1099-R or other relevant tax forms.

It’s essential for policyholders to understand these rules to comply with IRS regulations and manage their tax obligations effectively.

Understanding the Tax Implications of Life Insurance Dividends

Life insurance dividends can be a valuable addition to your financial portfolio, but understanding their tax implications is crucial for maximizing their benefits. As discussed, life insurance dividends are generally not taxable if they are considered a return of premium. However, certain situations may lead to tax liabilities, such as when dividends exceed the total premiums paid or are left to accumulate interest.

To navigate the complexities of life insurance dividends and their tax implications, it’s essential to review your policy details and consult with a tax professional. This ensures you are aware of any potential tax liabilities associated with your life insurance dividends. By doing so, you can make informed decisions about your policy and optimize its benefits.

Are life insurance dividends taxable? The answer depends on several factors, including the type of policy and how dividends are used. By understanding these factors and the associated tax implications, you can better manage your life insurance policy and its role in your overall financial strategy.

FAQ

Are life insurance dividends considered taxable income?

Generally, life insurance dividends are not considered taxable income, as they are viewed as a return of premiums paid. However, there are certain situations where they may be subject to taxation.

What is the return of premium principle, and how does it relate to life insurance dividends?

The return of premium principle states that life insurance dividends are considered a return of the premiums paid, rather than income. This principle is the basis for the general rule that life insurance dividends are not taxable.

Under what circumstances might life insurance dividends become taxable?

Life insurance dividends may become taxable if they exceed the total premiums paid on the policy, or if they are earned on accumulated dividends. Additionally, if dividends are used to purchase additional insurance or are accumulated with interest, the interest earned may be subject to taxation.

How do different dividend options affect the tax implications of life insurance dividends?

The tax implications of life insurance dividends can vary depending on the dividend option chosen. For example, if dividends are taken as cash, they are generally not taxable. However, if dividends are accumulated with interest, the interest earned may be subject to taxation.

Are dividends from term life insurance policies taxable?

Term life insurance policies typically do not pay dividends. However, some term life insurance policies, such as participating term life insurance, may pay dividends. The tax treatment of these dividends would follow the same principles as dividends from other types of life insurance policies.

How do I report taxable life insurance dividends on my tax return?

If life insurance dividends are taxable, they should be reported on your tax return as “other income.” You will typically receive a Form 1099-INT from the insurance company showing the amount of taxable interest or dividends earned.

Can I avoid taxes on life insurance dividends by choosing certain dividend options?

While certain dividend options may help minimize taxes, it’s essential to understand the tax implications of each option. For example, taking dividends as cash or using them to reduce premiums may be more tax-efficient than accumulating them with interest.

Are there any IRS regulations or rules that specifically address the taxation of life insurance dividends?

Yes, the IRS provides guidance on the taxation of life insurance dividends in the Internal Revenue Code and related regulations. It’s essential to consult these resources or seek professional advice to ensure compliance with IRS regulations.