Choosing the right life insurance can be a daunting task, especially when deciding between whole life insurance and Indexed Universal Life (IUL) insurance.

Both options offer unique benefits, but understanding their differences is crucial for making an informed decision that aligns with your financial goals.

When comparing whole life insurance and IUL, it’s essential to consider factors such as premium costs, death benefits, and cash value accumulation.

Key Takeaways

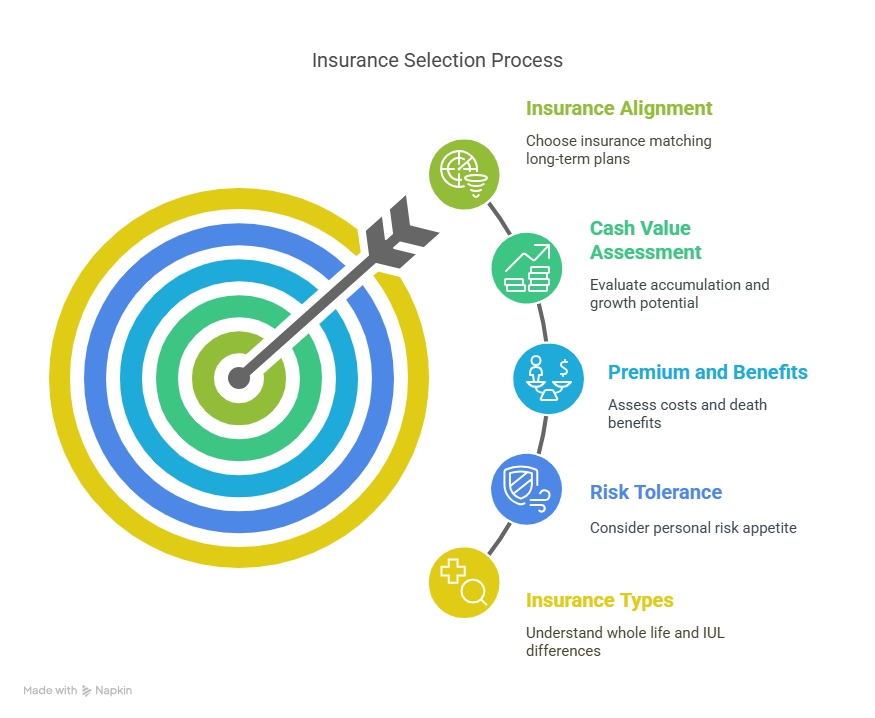

- Understand the differences between whole life insurance and IUL.

- Consider your financial goals and risk tolerance.

- Evaluate premium costs and death benefits.

- Assess cash value accumulation and growth potential.

- Determine which type of insurance aligns with your long-term plans.

Understanding Whole Life Insurance and IUL Basics

Understanding the core features of whole life insurance and Indexed Universal Life (IUL) is vital for selecting the right insurance for your needs. Both types offer unique benefits, but they operate differently.

What is Whole Life Insurance?

Whole life insurance provides a guaranteed death benefit and a cash value component that grows over time. It offers whole life insurance benefits such as lifetime coverage, a guaranteed cash value accumulation, and fixed premiums. One of the significant whole life insurance advantages is its predictability and stability, making it a reliable choice for long-term financial planning.

What is Indexed Universal Life (IUL)?

Indexed Universal Life (IUL) insurance combines a death benefit with a savings component that can earn interest based on the performance of a specific stock market index. IUL policies offer flexibility in premium payments and the potential for higher cash value growth compared to traditional whole life insurance. Understanding the difference between whole life and indexed universal life is crucial, as IUL’s cash value growth is tied to market performance, introducing an element of risk.

| Feature | Whole Life Insurance | Indexed Universal Life (IUL) |

|---|---|---|

| Premiums | Fixed | Flexible |

| Cash Value Growth | Guaranteed | Tied to market index |

| Risk Level | Low | Moderate |

Whole Life Insurance vs IUL: Key Differences

To make an informed decision, it’s essential to explore the key differences between whole life insurance and IUL. Understanding these distinctions will help you choose the insurance product that best aligns with your financial goals and risk tolerance.

Premium Structure and Flexibility

Whole life insurance typically comes with fixed premiums that remain the same throughout your life. In contrast, IUL offers flexible premiums, allowing you to adjust your payments based on your financial situation.

Cash Value Growth and Investment Potential

The cash value of whole life insurance grows at a guaranteed rate, providing a predictable and stable accumulation of value over time. IUL ties its cash value growth to the performance of selected market indexes, offering the potential for higher returns but also introducing market risk.

Risk Levels and Guaranteed Benefits

Whole life insurance is generally considered a low-risk investment, with guaranteed death benefits and cash value accumulation. IUL carries more risk due to its investment component.

Whole Life Insurance Guarantees

Whole life insurance policies typically come with guaranteed death benefits and a guaranteed cash value component.

IUL Market Performance Considerations

IUL performance is tied to market indexes, meaning its cash value can fluctuate based on market conditions.

- Key differences between whole life insurance and IUL include premium structure, cash value growth, and risk levels.

- Understanding these differences is crucial for making an informed decision.

- Whole life insurance offers predictability, while IUL provides flexibility and potential for higher returns.

Choosing Between Whole Life and IUL Insurance

The choice between whole life insurance and Indexed Universal Life (IUL) insurance depends on several factors, including your financial objectives and risk tolerance. Both types of insurance offer lifetime coverage and a cash value component, but they differ significantly in their structure and benefits.

Who Benefits Most from Whole Life Insurance?

Whole life insurance is ideal for individuals seeking predictable premiums and guaranteed cash value growth. It is particularly beneficial for those who value stability and predictability in their insurance policies. For instance, conservative investors who prioritize guaranteed returns over potential high gains might find whole life insurance more appealing. Additionally, whole life insurance can be a valuable tool for estate planning, providing a guaranteed death benefit that can help cover estate taxes or other expenses.

When IUL Might Be the Better Option

IUL, on the other hand, is more suitable for individuals who are comfortable with some level of risk and are looking for the potential to earn higher returns on their cash value. IUL policies allow the policyholder to allocate their cash value to various investment options, which can result in higher growth potential compared to traditional whole life insurance. However, it’s essential to understand that IUL returns are tied to the performance of the underlying investments, and there may be caps or fees associated with these policies.

In conclusion, when choosing between whole life insurance and IUL, it’s crucial to assess your financial goals, risk tolerance, and insurance needs. By understanding the key differences and benefits of each, you can make an informed decision that aligns with your overall financial strategy.

Choosing the Right Insurance for Your Future

Understanding the difference between whole life and indexed universal life insurance is crucial for making informed decisions about your financial security. When comparing whole life insurance vs IUL, it’s essential to consider your long-term goals, financial situation, and risk tolerance.

A whole life insurance comparison highlights its guaranteed benefits and stable cash value growth, making it suitable for those seeking predictability. On the other hand, the difference between whole life and indexed universal life lies in IUL’s potential for higher returns tied to market performance, albeit with associated risks.

Ultimately, the choice between whole life insurance and IUL depends on your individual needs and priorities. Evaluating whole life insurance benefits, such as lifetime coverage and cash value accumulation, against IUL’s flexibility and investment potential will help you make a decision that aligns with your financial objectives.

FAQ

What are the main differences between whole life insurance and Indexed Universal Life (IUL) insurance?

Whole life insurance provides a guaranteed death benefit and a cash value component that grows at a fixed rate, whereas IUL insurance offers a death benefit and a cash value that can grow based on the performance of a specific stock market index, such as the S&P 500.

How do premium structures differ between whole life insurance and IUL?

Whole life insurance typically has fixed premiums that remain the same throughout the policy’s life, while IUL premiums can be flexible, allowing policyholders to adjust their premium payments within certain limits.

What are the benefits of whole life insurance?

Whole life insurance provides a guaranteed death benefit, a guaranteed cash value component, and potentially tax-deferred growth, making it a stable and predictable insurance product.

How does the cash value of whole life insurance compare to IUL?

Whole life insurance cash value grows at a fixed rate, providing predictable and stable growth, whereas IUL cash value growth is tied to the performance of a specific market index, offering potentially higher returns but also carrying more risk.

Are there any premium fluctuations associated with whole life insurance or IUL?

Whole life insurance premiums are generally fixed, while IUL premiums can be flexible, but may require adjustments to maintain the policy’s integrity based on the performance of the underlying index.

What is the difference between whole life insurance and IUL in terms of risk levels?

Whole life insurance is generally considered a lower-risk option due to its guaranteed components, whereas IUL carries more risk due to its ties to market performance, which can result in variable cash value growth.

How do I choose between whole life insurance and IUL?

The choice between whole life insurance and IUL depends on your individual financial goals, risk tolerance, and preferences, with whole life insurance often suiting those seeking predictability and IUL appealing to those who are willing to take on more risk for potentially higher returns.

Can IUL be more cost-effective than whole life insurance?

IUL can potentially be more cost-effective than whole life insurance, depending on the performance of the underlying index and the policy’s design, but it may also come with higher fees and charges.