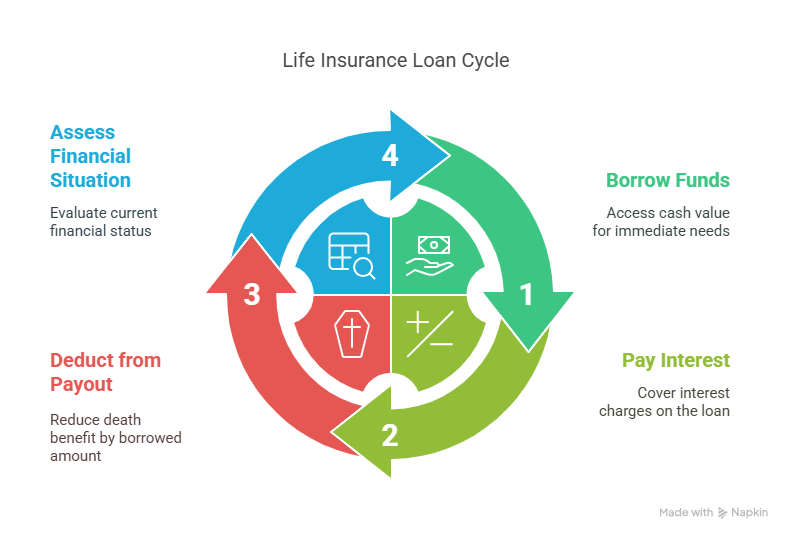

When it comes to financial planning, life insurance policies can be a valuable resource. Some policies allow you to borrow against their cash value, providing a source of funds in times of need.

Borrowing from a life insurance policy can be a convenient option, but it’s essential to understand the pros and cons. The borrowed amount is typically deducted from the policy’s payout upon the policyholder’s death, and interest may be charged on the loan.

Understanding the implications of borrowing from your policy is crucial. It’s a decision that requires careful consideration of your financial situation and goals.

Key Takeaways

- Some life insurance policies allow borrowing against their cash value.

- Borrowing can provide a source of funds in times of need.

- The borrowed amount is deducted from the policy’s payout upon death.

- Interest may be charged on the loan.

- Careful consideration of your financial situation is necessary.

Which Life Insurance Can You Borrow From?

When considering borrowing against a life insurance policy, it’s essential to understand which types of policies allow this financial flexibility. Not all life insurance policies are created equal, and the ability to borrow against them depends on the policy type.

The two primary types of life insurance that allow borrowing are Whole Life Insurance and Universal Life Insurance. Let’s delve into the specifics of each.

Whole Life Insurance

Whole Life Insurance policies accumulate a cash value over time, which can be borrowed against. This type of insurance provides a guaranteed death benefit and a guaranteed cash value component. The cash value grows at a fixed rate, making it a stable source of funds for policyholders.

Universal Life Insurance

Universal Life Insurance also builds cash value, and policyholders can borrow against this amount. Universal Life Insurance offers more flexibility than Whole Life Insurance, as it allows adjustments to premiums and death benefits. The cash value earns interest based on current interest rates.

Why Term Life Insurance Doesn’t Qualify

Term Life Insurance does not have a cash value component, making it impossible to borrow against. This type of insurance provides coverage for a specified term and pays a death benefit if the policyholder dies during that term. Since it doesn’t accumulate cash value, it’s not an option for those seeking loan options with life insurance.

How to Borrow From Your Life Insurance Policy

The process of borrowing from a life insurance policy involves several key steps that policyholders should be aware of. To begin, it’s essential to understand the type of life insurance policy you have, as not all policies allow borrowing.

The Application Process

To borrow from your life insurance policy, you’ll typically need to contact your insurance provider and request a loan. The application process is usually straightforward and may involve filling out a form or providing some basic information about your policy.

Interest Rates and Repayment Terms

Life insurance loans often come with competitive interest rates, which can vary depending on the insurer and the specific policy. Repayment terms are also flexible, but it’s crucial to understand that any outstanding loan balance will be deducted from the policy’s payout if not repaid.

| Insurance Provider | Interest Rate | Repayment Term |

|---|---|---|

| Provider A | 4% | Flexible |

| Provider B | 5% | 10 years |

| Provider C | 3.5% | Variable |

Tax Implications to Consider

One of the benefits of borrowing from a life insurance policy is that the loan is typically tax-free. However, if the policy lapses or is surrendered with an outstanding loan balance, there may be tax implications.

Advantages and Disadvantages of Life Insurance Loans

Life insurance loans can be a valuable financial tool, but they come with both benefits and drawbacks. When considering borrowing from your life insurance, it’s essential to weigh these factors carefully.

Benefits of Policy Loans

One of the significant advantages of borrowing from your life insurance is the flexibility and ease it offers. Here are some key benefits:

No Credit Check Required

Unlike traditional loans, borrowing from your life insurance policy doesn’t require a credit check. This makes it an attractive option for those with poor credit history.

Flexible Repayment Options

Repayment terms are often flexible, allowing you to manage your finances without undue stress. You can typically repay the loan at your convenience, although interest may accrue.

Potentially Lower Interest Rates

The interest rates on life insurance loans are often lower than those of traditional loans, making them a more affordable borrowing option.

| Benefits | Features |

|---|---|

| No Credit Check | Easier access to funds |

| Flexible Repayment | Manageable financial stress |

| Lower Interest Rates | More affordable borrowing |

Potential Risks to Consider

While there are benefits, there are also risks associated with borrowing from your life insurance policy.

Reduced Death Benefit

Borrowing against your policy can reduce the death benefit paid to your beneficiaries.

Compounding Interest Concerns

If not managed properly, the interest on your loan can compound, increasing the amount you owe.

Policy Lapse Dangers

Failure to repay the loan can lead to your policy lapsing, leaving you without coverage.

Conclusion: Making the Right Decision About Policy Loans

When considering borrowing from a life insurance policy, it’s essential to understand which life insurance policies allow borrowing. Whole life and universal life insurance policies are the primary options that permit policy loans.

Borrowing from your life insurance can provide financial flexibility, but it’s crucial to weigh the pros and cons. Policy loans can offer a relatively easy and tax-free way to access cash, but they can also reduce the policy’s death benefit and cash value.

To make an informed decision about borrowing from your life insurance policy, consider the interest rates, repayment terms, and potential tax implications. Carefully reviewing these factors will help you determine whether a policy loan is the right choice for your financial situation.

Ultimately, understanding which life insurance can you borrow from and the associated benefits and risks is vital to making a decision that aligns with your financial goals.

FAQ

Which life insurance policies can I borrow from?

You can borrow from whole life insurance and universal life insurance policies, as they have a cash value component. Term life insurance policies do not allow borrowing.

How do I borrow against my life insurance policy?

To borrow against your life insurance policy, you’ll need to contact your insurance provider and apply for a loan. The application process typically involves submitting a request and providing policy details.

What are the interest rates for life insurance loans?

Interest rates for life insurance loans vary depending on the insurance provider and policy terms. Generally, these rates are relatively low, often ranging between 4% to 8% per annum.

Are there tax implications when borrowing from my life insurance?

Generally, loans taken against a life insurance policy are not considered taxable income. However, if your policy lapses or is surrendered with an outstanding loan, there may be tax implications.

Can I repay my life insurance loan at any time?

Yes, most life insurance policies allow you to repay the loan at any time. Flexible repayment options are often available, but be sure to review your policy terms to understand any specific requirements.

What happens if I don’t repay my life insurance loan?

If you don’t repay your life insurance loan, the outstanding amount will be deducted from the policy’s death benefit when you pass away. Failure to repay can also lead to policy lapse if the loan balance exceeds the policy’s cash value.

Can I use my life insurance policy as collateral for a loan?

While you can’t directly use your life insurance as collateral for a traditional loan, you can borrow against the policy’s cash value. This serves a similar purpose, providing you with access to funds when needed.

How does borrowing from my life insurance affect the death benefit?

Borrowing from your life insurance policy can reduce the death benefit paid to your beneficiaries. The outstanding loan amount, plus any accrued interest, will be subtracted from the death benefit.