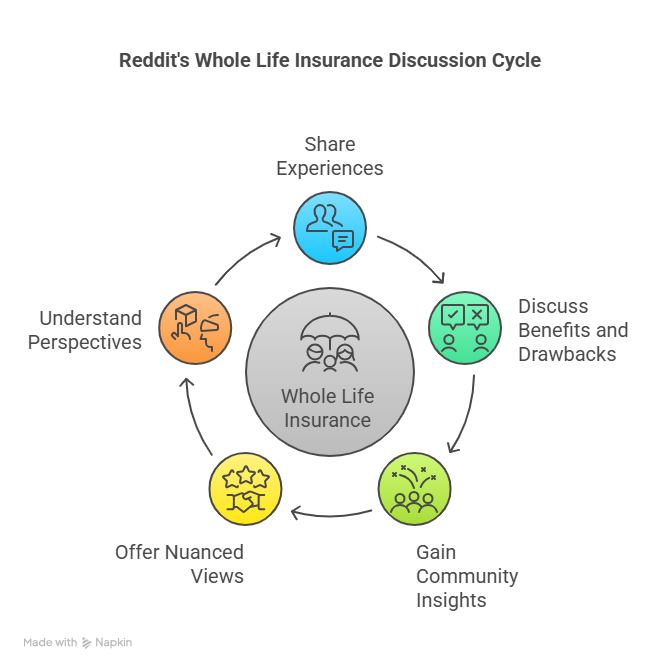

When it comes to understanding whole life insurance, opinions are varied and often complex. One of the most insightful places to explore these discussions is on Reddit, a community-driven platform where users share their real-life experiences and opinions.

Reddit provides a unique lens through which we can examine the pros and cons of whole life insurance policies. By delving into the discussions on this platform, we can gain a deeper understanding of how people perceive the value and drawbacks of such insurance products.

This insight is invaluable in making informed decisions about whether or not to invest in whole life insurance.

Key Takeaways

- Reddit users share diverse experiences with whole life insurance.

- Discussions highlight both benefits and drawbacks.

- Community insights can aid in making informed decisions.

- Real opinions on Reddit offer a nuanced view.

- Understanding different perspectives is crucial.

The Whole Life Insurance Reddit Landscape

Reddit’s vast community provides a diverse range of perspectives on whole life insurance, making it a valuable resource for those researching this type of insurance. The platform hosts numerous financial communities where users discuss various aspects of whole life insurance.

Reddit’s Financial Communities and Their Influence

Reddit’s financial communities, such as r/insurance and r/financialindependence, have a significant influence on how whole life insurance is perceived. These communities allow users to share their experiences, ask questions, and receive feedback from others who have dealt with similar issues.

How Redditors Discuss Insurance Products

When discussing insurance products, Redditors often share detailed analyses of policy benefits, costs, and potential drawbacks. honest reviews of their experiences with whole life insurance policies. This openness helps others make informed decisions about their insurance choices.

Popular Positive Opinions from Reddit Users

Redditors have been vocal about the benefits of whole life insurance, citing its estate planning advantages and cash value component. Many users appreciate the comprehensive nature of whole life insurance, which provides both a death benefit and a savings component.

Estate Planning Benefits Highlighted by Redditors

Reddit users often highlight the estate planning benefits of whole life insurance. The policy’s ability to provide liquidity for estate taxes and other expenses is particularly valued. Estate planning is a critical aspect of financial planning, and whole life insurance is seen as a valuable tool in this process.

Cash Value Advantages According to Reddit

The cash value component of whole life insurance is another significant advantage noted by Redditors. Users appreciate that a portion of their premiums goes into a savings account, which can be borrowed against or used to pay premiums. This feature provides a financial safety net and can be a valuable resource in times of need.

Specific Scenarios Where Redditors Endorse Whole Life

Redditors recommend whole life insurance for various specific scenarios, including business owners who want to ensure business continuity and individuals with dependents. The policy’s predictability and guaranteed death benefit make it an attractive option for those seeking long-term financial security.

| Scenario | Whole Life Insurance Benefit |

|---|---|

| Business Owners | Ensures business continuity with liquidity for succession planning |

| Individuals with Dependents | Provides a guaranteed death benefit for financial security |

| Estate Planning | Offers liquidity for estate taxes and expenses |

Critical Perspectives in Whole Life Insurance Reddit Threads

While some Reddit users praise whole life insurance, others have raised several criticisms that are worth considering. These critical perspectives offer valuable insights into the potential drawbacks of whole life insurance and help provide a more nuanced understanding of its role in financial planning.

The “Buy Term and Invest the Difference” Argument

One of the most common criticisms of whole life insurance on Reddit is the “buy term and invest the difference” argument. Proponents of this view argue that term life insurance is more cost-effective and that the difference in premiums between term and whole life insurance can be invested elsewhere for potentially higher returns. This perspective is often supported by examples of investment opportunities that have historically outperformed the cash value accumulation of whole life insurance policies.

Redditors who advocate for this approach emphasize the importance of financial literacy and the ability to manage investments wisely. They suggest that individuals who are disciplined in their financial planning can achieve better outcomes by separating their life insurance coverage from their investment strategies.

Criticism of Commission Structure from Former Agents

Former insurance agents on Reddit have also criticized whole life insurance by highlighting the commission structure that incentivizes agents to sell these policies. They argue that the high commissions associated with whole life insurance can lead to a conflict of interest, where agents prioritize their financial gain over the client’s best interests. This criticism is particularly relevant given the complexity of whole life insurance products and the potential for agents to recommend policies that are not in the client’s favor.

These former agents often suggest that the sales practices in the insurance industry can be misleading, with some agents focusing on the commission rather than the suitability of the product for the client’s needs. Redditors have shared stories of being sold whole life insurance policies without being fully informed about the associated costs and benefits.

Alternative Financial Products Recommended by Redditors

In addition to criticizing whole life insurance, many Redditors recommend alternative financial products that can achieve similar goals more effectively. For example, some users suggest investing in tax-advantaged retirement accounts or utilizing other investment vehicles that offer more flexibility and potentially higher returns than the cash value component of whole life insurance.

Others recommend exploring alternative insurance products, such as term life insurance with convertible options or other hybrid policies that combine elements of life insurance with investment features. The Reddit community emphasizes the importance of diversifying one’s financial portfolio and considering a range of options before committing to whole life insurance.

Conclusion: What to Take Away from Reddit’s Whole Life Insurance Discussions

Reddit discussions on whole life insurance offer a diverse range of perspectives, from enthusiastic endorsements to critical evaluations. When evaluating whole life insurance based on reddit whole life insurance discussions, it’s essential to consider both the benefits and drawbacks highlighted by the community.

The estate planning benefits and cash value advantages of whole life insurance are frequently cited as significant advantages. However, critics on Reddit also raise valid points, such as the “buy term and invest the difference” argument and concerns about commission structures.

Ultimately, reddit whole life insurance discussions suggest that whole life insurance can be a valuable component of a comprehensive financial plan for some individuals, particularly those with specific estate planning needs or a desire for a guaranteed death benefit. Readers should weigh these insights against their personal financial goals and circumstances to make informed decisions.

FAQ

What is whole life insurance, and how does it work?

Whole life insurance is a type of life insurance that provides coverage for your entire lifetime, as long as premiums are paid. It also accumulates a cash value over time, which can be borrowed against or used to pay premiums.

Is whole life insurance a good investment according to Reddit users?

Opinions on Reddit vary, but some users view whole life insurance as a stable, long-term investment with tax benefits, while others criticize its complexity and costs. Some Redditors recommend it for its guaranteed returns and cash value accumulation.

What are the benefits of whole life insurance discussed on Reddit?

Redditors highlight benefits such as lifetime coverage, cash value growth, tax-deferred savings, and the ability to take out loans against the policy. Estate planning is also a commonly mentioned advantage.

How do Redditors view the “buy term and invest the difference” strategy in relation to whole life insurance?

Many Redditors support the “buy term and invest the difference” approach, arguing it can be more cost-effective and allow for greater investment flexibility. They often compare the costs of term life insurance to whole life insurance, suggesting that investing the difference can yield higher returns.

Can you recommend a whole life insurance provider based on Reddit discussions?

While recommendations vary, some popular whole life insurance providers mentioned on Reddit include Northwestern Mutual, Guardian Life Insurance, and New York Life. It’s essential to research and compare different providers based on individual needs and circumstances.

Are there any criticisms of whole life insurance on Reddit that I should be aware of?

Yes, criticisms include high premiums, complex policy structures, and the potential for lower returns compared to other investments. Some former insurance agents on Reddit have also criticized the commission structures of whole life insurance policies.

How do I know if whole life insurance is right for me based on Reddit advice?

Reddit users often suggest considering your financial goals, risk tolerance, and current financial situation. They recommend weighing the pros and cons, understanding the policy terms, and potentially consulting with a financial advisor before making a decision.