Understanding the intricacies of life insurance coverage is crucial, especially when it comes to serious health issues like cancer. Policyholders often wonder if their insurance will provide the necessary financial support during such challenging times.

Knowing whether your insurance policy covers cancer can significantly impact your financial planning and peace of mind. It’s essential to review your policy details and understand what is covered.

Key Takeaways

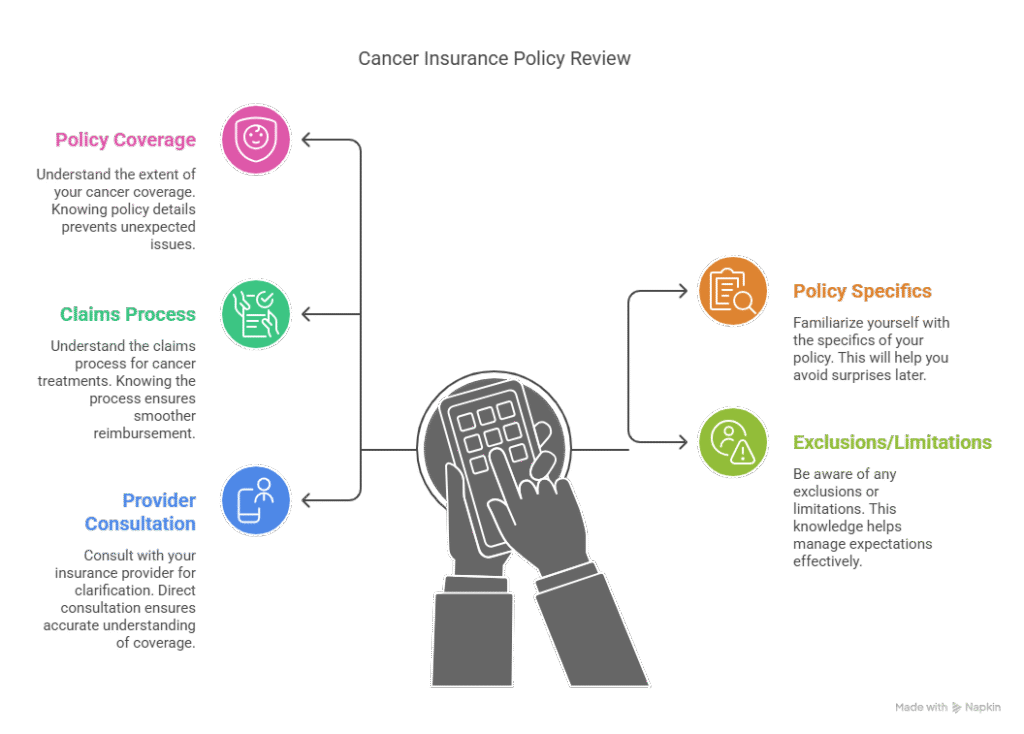

- Review your insurance policy to understand cancer coverage.

- Know the specifics of your policy to avoid surprises.

- Understand the claims process for cancer-related treatments.

- Be aware of any exclusions or limitations in your policy.

- Consult with your insurance provider for clarification on coverage.

Understanding Life Insurance Coverage for Cancer

Cancer diagnosis can significantly impact life insurance; knowing how policies handle such situations is key. Life insurance provides financial protection for loved ones in the event of the policyholder’s death. When cancer is involved, understanding the specifics of this coverage becomes crucial.

How Standard Policies Handle Cancer Deaths

Standard life insurance policies generally cover deaths resulting from cancer, provided the policy is active and premiums are up to date. However, the circumstances surrounding the policy’s issuance, such as disclosure of pre-existing conditions, can affect the payout. It’s essential to review your policy terms carefully.

The Critical Difference Between New and Existing Policies

The treatment of cancer under life insurance can vary significantly between new and existing policies. Existing policies typically continue to cover cancer-related deaths without issue, assuming premiums are paid. New policies, however, may involve a review of medical history, potentially affecting coverage or premiums. Understanding these differences is vital for policyholders.

| Policy Type | Cancer Coverage | Premiums |

|---|---|---|

| Existing Policies | Generally Covered | Unaffected |

| New Policies | Dependent on Medical History | May Increase |

Will Life Insurance Cover Cancer? The Complete Answer

For those diagnosed with cancer, knowing the extent of their life insurance coverage is essential. Life insurance policies are designed to provide financial protection to beneficiaries in the event of the policyholder’s death. However, the extent of this coverage can vary significantly depending on the type of policy and any additional features or riders that may be included.

Term Life Insurance and Cancer Coverage

Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years). If the policyholder dies within this term, the insurance company pays out the death benefit to the beneficiaries. Generally, term life insurance policies do not cover deaths due to cancer if the cancer was present before the policy was purchased, unless the policy includes a conversion option or is a guaranteed issue policy.

Whole Life and Universal Life Policies

Whole life insurance and universal life insurance are types of permanent life insurance that cover the policyholder for their entire lifetime, provided premiums are paid. These policies often accumulate a cash value over time. Whole life insurance typically covers deaths due to cancer, as long as premiums are up to date. Universal life insurance also covers cancer-related deaths, but the coverage can be affected by the policy’s cash value and the premium payments.

Critical Illness Riders and Accelerated Death Benefits

Some life insurance policies offer critical illness riders or accelerated death benefits (ADBs) that allow policyholders to receive a portion of the death benefit while still alive if they are diagnosed with a critical illness like cancer. This can help cover medical expenses or other costs associated with the illness.

| Policy Type | Cancer Coverage | Additional Features |

|---|---|---|

| Term Life Insurance | Covers cancer deaths if diagnosed after policy purchase | Conversion option, Guaranteed Issue |

| Whole Life Insurance | Covers cancer deaths, lifetime coverage | Cash value accumulation |

| Universal Life Insurance | Covers cancer deaths, flexible premiums | Cash value accumulation, adjustable death benefit |

Obtaining Life Insurance with a Cancer History

Navigating the process of obtaining life insurance with a history of cancer can be complex and overwhelming. However, understanding the requirements and options available can simplify this process.

Application Disclosure Requirements

When applying for life insurance after a cancer diagnosis, disclosure is crucial. Applicants must provide detailed medical history, including diagnosis, treatment, and follow-up care.

Waiting Periods After Cancer Treatment

Insurance companies often impose waiting periods after cancer treatment before considering an application. The length of this period varies depending on the type of cancer and the insurance provider.

Guaranteed Issue and Simplified Issue Options

For those who have had cancer, Guaranteed Issue and Simplified Issue life insurance policies are available. These policies have less stringent underwriting requirements, making it easier for cancer survivors to obtain coverage.

How Cancer History Affects Premiums

A history of cancer can impact life insurance premiums. The effect depends on the type of cancer, the stage at diagnosis, and the treatment outcome. Generally, premiums are higher for cancer survivors than for those without a cancer history.

| Factor | Impact on Premiums | Insurance Company Consideration |

|---|---|---|

| Type of Cancer | Higher for aggressive cancers | Medical underwriting |

| Stage at Diagnosis | Higher for later stages | Prognosis and survival rates |

| Treatment Outcome | Lower for successful treatments | Follow-up care and recurrence risk |

Understanding these factors can help cancer survivors make informed decisions when seeking life insurance, ensuring they find the best possible coverage for their situation.

Conclusion: Securing Your Family’s Financial Future

Navigating life insurance options after a cancer diagnosis can be challenging, but it’s crucial for protecting your family’s financial well-being. Understanding your life insurance options for cancer patients is the first step towards securing a stable future.

As discussed, various life insurance policies, including term life, whole life, and universal life insurance, offer different levels of coverage for cancer patients. Exploring these options and considering additional features like critical illness riders can provide comprehensive protection.

If you’ve been diagnosed with cancer, it’s not too late to explore getting life insurance after cancer diagnosis. While premiums may be affected by your medical history, there are still viable options available, such as guaranteed issue and simplified issue policies.

By taking proactive steps to secure the right life insurance coverage, you can ensure your loved ones are financially protected, regardless of what the future holds. It’s essential to review your options carefully and make informed decisions to safeguard your family’s financial future.

FAQ

Will life insurance cover cancer treatment costs?

Life insurance policies typically do not cover treatment costs directly. However, some policies offer accelerated death benefits or critical illness riders that can provide financial assistance during cancer treatment.

Does having cancer affect my ability to get life insurance?

Having cancer can impact your ability to obtain life insurance, as insurers assess cancer history and treatment outcomes when determining premiums and coverage eligibility. However, options like guaranteed issue or simplified issue policies may be available.

How does a cancer diagnosis impact life insurance premiums?

A cancer diagnosis can increase life insurance premiums, as insurers view cancer survivors as higher-risk policyholders. The extent of the premium increase depends on factors like cancer type, stage, and treatment outcome.

Can I get life insurance after being diagnosed with cancer?

Yes, it is possible to obtain life insurance after a cancer diagnosis, although the process may be more complex. Some insurers offer specialized policies or riders for cancer patients, and working with an experienced insurance professional can help navigate the application process.

What is the difference between term life insurance and whole life insurance for cancer patients?

Term life insurance provides coverage for a specified period, while whole life insurance offers lifetime coverage. Cancer patients may find term life insurance more accessible, but whole life policies can provide a guaranteed death benefit and cash value accumulation.

Are there specific life insurance policies designed for cancer patients?

Some insurers offer specialized policies, such as guaranteed issue or simplified issue life insurance, designed for individuals with health conditions, including cancer. These policies often have fewer underwriting requirements but may have higher premiums or lower coverage limits.

How do critical illness riders work with life insurance and cancer coverage?

Critical illness riders can be added to life insurance policies to provide a lump-sum payment upon diagnosis of a critical illness, such as cancer. This benefit can help cover treatment costs, living expenses, or other financial obligations.

What are the application disclosure requirements for life insurance with a cancer history?

When applying for life insurance with a cancer history, it is essential to disclose all relevant information, including diagnosis, treatment, and medical records. Failure to disclose this information can lead to policy cancellation or claim denial.

Are there waiting periods after cancer treatment before I can apply for life insurance?

Some insurers impose waiting periods after cancer treatment before considering an application for life insurance. The length of the waiting period varies depending on the insurer, cancer type, and treatment outcome.