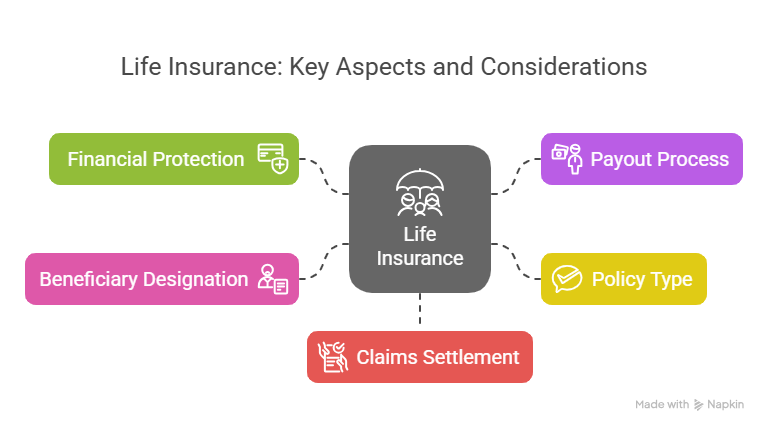

Life insurance is a vital financial tool that provides a safety net for loved ones in the event of the policyholder’s death.

Understanding life insurance payouts is crucial for both policyholders and beneficiaries to ensure that benefits are received in a timely and efficient manner.

The payout process involves several steps and considerations, including the type of policy and beneficiary designation.

Key Takeaways

- Life insurance provides financial protection for beneficiaries.

- Understanding the payout process is essential.

- The type of policy affects the payout.

- Beneficiary designation is critical.

- Timely claims settlement is vital.

The Basics of How Life Insurance Pays Out

Understanding the payout process of life insurance is crucial for policyholders and their beneficiaries. Life insurance policies are contracts between the policyholder and the insurance company, where the insurer agrees to pay a death benefit to the beneficiary upon the policyholder’s death, provided that the policy is in force.

The payout process involves several key factors, including the type of life insurance policy and the designation of beneficiaries. It’s essential to comprehend these elements to ensure that the policyholder’s wishes are carried out as intended.

Types of Life Insurance Policies and Their Payout Structures

There are primarily two types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, and pays out a death benefit if the policyholder dies during the term. Permanent life insurance, on the other hand, covers the policyholder for their entire life and often includes a cash value component that accumulates over time.

| Policy Type | Payout Structure | Key Features |

|---|---|---|

| Term Life Insurance | Pays death benefit if policyholder dies during the term | Coverage for a specified period, typically 10-30 years |

| Permanent Life Insurance | Pays death benefit and includes a cash value component | Covers policyholder for their entire life, with a cash value accumulation |

Who Can Be Named as a Beneficiary

Beneficiaries can be individuals, trusts, or even charities. Policyholders can designate primary beneficiaries, who are the first in line to receive the death benefit, and secondary beneficiaries, who receive the benefit if the primary beneficiaries predecease the policyholder.

The Life Insurance Claim Process

Understanding the life insurance claim settlement process is essential for beneficiaries to receive life insurance funds in a timely manner. The process involves several steps that beneficiaries must follow to file a claim and receive the payout.

Required Documentation for Filing a Claim

To initiate the life insurance payout process, beneficiaries typically need to provide the insurance company with specific documents. These include the policyholder’s death certificate, the original life insurance policy documents, and a completed claim form provided by the insurance company. Ensuring that all documents are accurately filled out and submitted promptly is crucial for a smooth claim process.

Typical Timeline for Receiving Benefits

The timeline for receiving life insurance funds can vary depending on several factors, including the complexity of the claim and the efficiency of the insurance company. Generally, insurance companies aim to settle claims within a few weeks to a couple of months. Beneficiaries should stay in touch with the insurance company to ensure that their claim is being processed and to address any issues that may arise during the claim settlement process.

Being prepared and understanding the requirements can significantly reduce the stress associated with the claim process. Beneficiaries who are well-informed about what to expect can navigate the process more effectively, ensuring they receive the financial support they need in a timely manner.

Payout Options Available to Beneficiaries

Beneficiaries of life insurance policies have several options for receiving payouts, each with its own financial implications. Understanding these options is crucial for making informed decisions about how to manage the insurance policy payout details.

The choice of payout option depends on the beneficiary’s financial situation and goals. It’s essential to consider the financial implications of each option to ensure the chosen method aligns with their needs.

Lump Sum Payments

A lump sum payment provides beneficiaries with immediate access to the life insurance benefits distribution. This option allows them to use the funds as needed, whether for funeral expenses, debt repayment, or other financial obligations.

Installment or Annuity Options

Beneficiaries can also choose to receive the payout in installments or through an annuity, which can provide a steady income stream over time. This option can help ensure long-term financial stability.

Retained Asset Accounts

Retained asset accounts allow beneficiaries to hold the payout in an interest-bearing account, offering flexibility in managing the funds. This option provides liquidity while earning interest on the payout amount.

| Payout Option | Key Features | Financial Implications |

|---|---|---|

| Lump Sum | Immediate access to funds | Tax implications, potential for immediate financial obligations |

| Installment/Annuity | Steady income stream over time | Long-term financial stability, potential tax benefits |

| Retained Asset Account | Flexibility, interest-bearing | Liquidity, potential for interest earnings |

Conclusion: Ensuring a Smooth Payout Process

Understanding how life insurance pays out is crucial for beneficiaries to navigate the process effectively. By grasping the basics of life insurance payouts, beneficiaries can make informed decisions that suit their financial needs. The payout process and available options can significantly impact the financial implications of a life insurance payout.

To ensure a smooth payout process, it’s essential for policyholders to review and update their beneficiary designations and policy details regularly. This proactive approach can reduce stress and uncertainty during a difficult time, ensuring that the life insurance benefit serves its intended purpose. Beneficiaries should be aware of the available payout options, including lump sum payments, installment or annuity options, and retained asset accounts, to choose the one that best aligns with their financial situation.

By understanding life insurance payouts and the payout process, beneficiaries can better manage their financial future. This knowledge enables them to make the most of the life insurance benefit, providing financial security and peace of mind.

FAQ

What is the typical timeline for receiving life insurance benefits after filing a claim?

The timeline for receiving life insurance benefits can vary, but most insurance companies aim to settle claims within a few weeks to a couple of months. The exact timeframe depends on the complexity of the claim and the efficiency of the insurance company’s claim settlement process.

Can beneficiaries choose how they receive the life insurance payout?

Yes, beneficiaries often have options for how they receive the life insurance payout, including lump sum payments, installment or annuity options, and retained asset accounts. The available options depend on the policy’s payout structure and the insurance company’s offerings.

What documentation is required to file a life insurance claim?

To file a life insurance claim, beneficiaries typically need to provide the insurance company with the policyholder’s death certificate, the policy documents, and a completed claim form. Additional documentation may be required in certain circumstances, such as proof of identity or beneficiary designation.

How do different types of life insurance policies affect the payout process?

The type of life insurance policy can impact the payout process, as different policies have distinct payout structures. For example, term life insurance policies typically provide a straightforward payout, while permanent life insurance policies may involve a cash value component that affects the payout.

Who can be named as a beneficiary on a life insurance policy?

Beneficiaries can be individuals, trusts, or even charities, and they can be designated as primary or secondary beneficiaries. Policyholders have flexibility in choosing their beneficiaries, allowing them to tailor their life insurance coverage to their specific needs and goals.

What is a retained asset account, and how does it work?

A retained asset account is an interest-bearing account that allows beneficiaries to hold the life insurance payout, providing flexibility in managing the funds. Beneficiaries can access the funds as needed, and the account earns interest, helping to preserve the value of the payout.

How can beneficiaries ensure a smooth life insurance payout process?

Beneficiaries can help ensure a smooth payout process by understanding the policy’s payout structure, providing required documentation promptly, and communicating with the insurance company. It’s also essential for policyholders to review and update their beneficiary designations and policy details regularly.