Deciding whether to invest in a life insurance policy can be a daunting task. With so many options available, it’s natural to wonder if the benefits outweigh the costs. In this article, we’ll explore the pros and cons of life insurance coverage and provide expert insights to help you make an informed decision.

Understanding the benefits of life insurance is crucial in determining whether a policy is right for you. By examining the advantages and disadvantages, you can make a more informed decision about your financial security.

Key Takeaways

- Understanding the pros and cons of life insurance policies

- Expert insights to help you make an informed decision

- The importance of considering your financial security

- How to determine if a life insurance policy is right for you

- The benefits of having a life insurance policy

Understanding Life Insurance: Types and Coverage Options

The world of life insurance can be complex, with multiple types and coverage options available, each serving a unique purpose. To make informed decisions, it’s essential to understand the different types of life insurance policies and their respective coverage options.

Term Life Insurance vs. Whole Life Insurance

Two primary types of life insurance are Term Life Insurance and Whole Life Insurance. Term Life Insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It pays a death benefit if the policyholder dies during the term. Whole Life Insurance, on the other hand, covers the policyholder for their entire lifetime, as long as premiums are paid. It also accumulates a cash value over time.

The choice between Term and Whole Life Insurance depends on individual needs and financial goals. Term Life Insurance is often chosen for its affordability and simplicity, while Whole Life Insurance is selected for its lifetime coverage and cash accumulation benefits.

How Life Insurance Coverage and Premiums Are Determined

Life insurance coverage and premiums are determined based on several factors, including age, health, lifestyle, and the type of policy chosen. Insurers assess the risk associated with each applicant to determine the premium amount. Generally, younger and healthier individuals qualify for lower premiums.

| Factor | Impact on Premium | Example |

|---|---|---|

| Age | Increases with age | A 30-year-old pays less than a 50-year-old |

| Health | Healthier individuals pay less | Non-smokers pay less than smokers |

| Lifestyle | Risky behaviors increase premiums | Adventure sports enthusiasts may pay more |

Are Life Insurance Policies Worth It? Examining the Benefits

The benefits of life insurance extend beyond mere financial protection, offering a safety net for loved ones and a tool for estate planning. By understanding these benefits, individuals can make informed decisions about their financial security.

Financial Protection for Your Loved Ones

One of the primary reasons to get life insurance is the financial protection it offers to dependents. In the event of your passing, a life insurance policy ensures that your loved ones receive a death benefit, helping them cover funeral expenses, outstanding debts, and ongoing living costs.

- Pay off outstanding debts and mortgages

- Cover funeral expenses and other final costs

- Provide ongoing financial support for dependents

The Importance of Life Insurance in Estate Planning

Life insurance plays a crucial role in estate planning, providing liquidity to cover estate taxes and ensuring that your heirs receive their inheritance without significant tax burdens. Different types of life insurance can be used to achieve specific estate planning goals.

Tax Benefits and Investment Potential

Certain types of life insurance, such as whole life insurance, offer tax-deferred growth on the policy’s cash value, providing a potential source of funds for retirement or other financial needs. Additionally, life insurance proceeds are generally tax-free to beneficiaries.

Potential Drawbacks and Considerations

The decision to purchase life insurance involves weighing its advantages against potential disadvantages. While life insurance provides financial security for loved ones, there are also costs and limitations associated with these policies.

Cost Considerations and Premium Expenses

One of the primary considerations when purchasing life insurance is the cost of premiums. Life insurance premiums can vary significantly based on factors such as age, health, and the type of policy chosen. It’s essential to compare life insurance policies from different providers to find the most affordable option that meets your needs.

| Policy Type | Average Annual Premium | Coverage Duration |

|---|---|---|

| Term Life Insurance | $500-$1,500 | 10-30 years |

| Whole Life Insurance | $2,000-$5,000 | Lifetime |

Policy Limitations and Exclusions

Understanding the limitations and exclusions of a life insurance policy is crucial. Certain policies may not cover deaths resulting from specific activities or conditions. It’s vital to review the policy terms carefully to ensure you understand what is covered and what is not.

Expert Insights: Who Benefits Most from Life Insurance

According to experts, individuals with dependents, such as families with young children or those with significant financial obligations, benefit most from life insurance. Comparing policies and understanding the terms can help you make an informed decision.

Conclusion: Is Life Insurance Right for You?

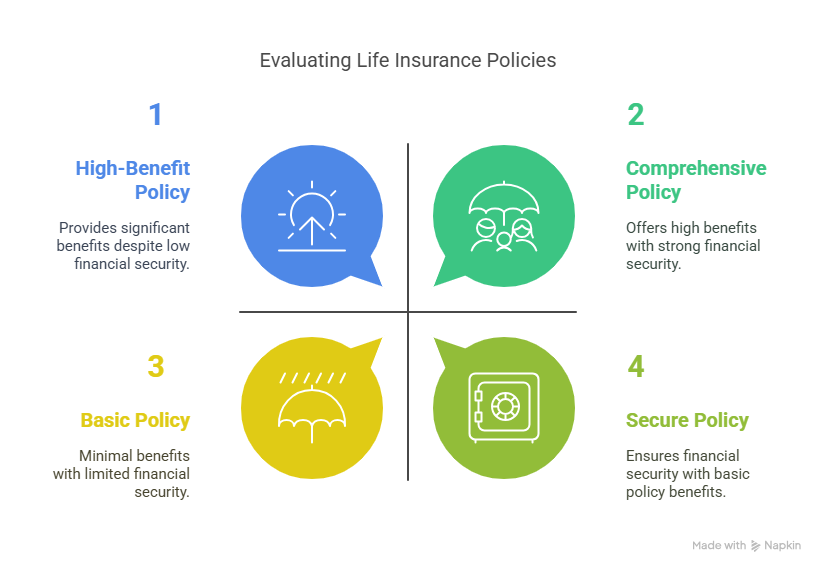

Deciding whether a life insurance policy is right for you depends on your individual circumstances and needs. When considering term life insurance vs whole life insurance, it’s essential to evaluate your financial goals, dependents, and long-term plans.

Life insurance provides financial protection for your loved ones and can play a crucial role in estate planning. By understanding the benefits and drawbacks of different life insurance options, you can make an informed decision that aligns with your financial situation and objectives.

Ultimately, assessing your personal needs and consulting with a financial advisor can help determine if investing in a life insurance policy is the right choice for you. Whether you opt for term life insurance or whole life insurance, having the right coverage can provide peace of mind and financial security for your family’s future.

FAQ

What are the main types of life insurance policies available?

The two primary types of life insurance policies are term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, whereas whole life insurance covers the insured for their entire lifetime, as long as premiums are paid.

How are life insurance premiums determined?

Life insurance premiums are determined based on several factors, including the insured’s age, health, lifestyle, and the type and amount of coverage chosen. Insurance companies also consider the risk associated with the policyholder’s occupation, hobbies, and other factors that may impact their life expectancy.

Are life insurance policies worth the cost?

Life insurance policies can be worth the cost for individuals who want to ensure financial protection for their loved ones in the event of their passing. The benefits of life insurance, including tax benefits and investment potential, can outweigh the costs for many people.

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specified term, usually ranging from 10 to 30 years, and pays a death benefit if the insured dies during that term. Whole life insurance, on the other hand, provides lifetime coverage and includes a cash value component that grows over time.

Can I compare different life insurance policies?

Yes, it’s essential to compare different life insurance policies to find the one that best suits your needs and budget. You can compare policies based on factors such as coverage amount, premium costs, and policy features.

What are the benefits of having a life insurance policy?

The benefits of having a life insurance policy include financial protection for your loved ones, estate planning, tax benefits, and investment potential. Life insurance can help ensure that your dependents are financially secure in the event of your passing.

Who benefits most from life insurance?

Individuals with dependents, such as spouses, children, or other family members, benefit most from life insurance. Additionally, business owners and individuals with significant debts or financial obligations may also benefit from having a life insurance policy.

How does life insurance fit into estate planning?

Life insurance can play a crucial role in estate planning by providing liquidity to pay estate taxes, funeral expenses, and other costs associated with settling an estate. It can also help ensure that your heirs receive a fair inheritance.