Securing life insurance can be a crucial step in planning for the future. It provides financial protection for your loved ones in the event of your passing, ensuring they are not burdened with expenses or debts.

The importance of life insurance cannot be overstated. It not only offers a safety net but also serves as a tool for long-term financial planning. By having life insurance, individuals can ensure their family’s financial stability, even in their absence.

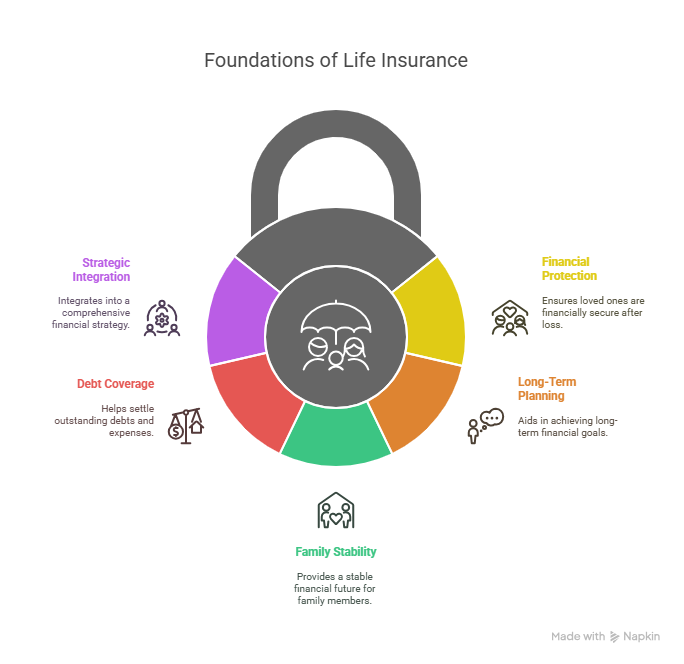

Key Takeaways

- Life insurance provides financial protection for your loved ones.

- It serves as a tool for long-term financial planning.

- Having life insurance ensures your family’s financial stability.

- It can help pay off debts and expenses after you’re gone.

- Life insurance can be a vital part of your overall financial strategy.

Why Life Insurance Is Needed in Today’s Uncertain World

The Protective Shield for Your Family’s Financial Future

Life insurance acts as a safeguard for your family’s financial future, ensuring that they are protected against the loss of income in the event of your passing. It provides a financial cushion that can help maintain their standard of living.

The following table highlights key financial benefits provided by life insurance:

| Financial Benefit | Description | Impact |

|---|---|---|

| Income Replacement | Replaces lost income | Maintains family’s standard of living |

| Debt Coverage | Covers outstanding debts | Prevents financial burden on family |

| Funeral Expenses | Covers funeral costs | Reduces financial stress during a difficult time |

Debunking Common Life Insurance Myths

Despite its importance, life insurance is often misunderstood. Common myths surround its cost, complexity, and necessity. In reality, life insurance is more affordable than many believe, and policies can be tailored to fit various needs and budgets.

By understanding the facts and dispelling myths, individuals can make informed decisions about their life insurance needs.

3 Immediate Reasons to Secure Life Insurance Now

Understanding the immediate benefits of life insurance can be the first step towards protecting your family’s financial well-being. Securing life insurance coverage is a proactive measure that can provide peace of mind in uncertain times.

1. Providing Financial Support for Your Dependents

Life insurance ensures that your dependents are financially supported in the event of your passing. This support can be crucial for maintaining their lifestyle and achieving long-term goals. By securing life insurance, you can ensure that your loved ones are protected.

2. Covering Funeral and End-of-Life Expenses

Funeral expenses can be a significant burden on your loved ones. Life insurance can provide the necessary funds to cover these costs, alleviating some of the financial stress during a difficult time. Knowing that these expenses are covered can be a significant relief.

3. Ensuring Your Debts Don’t Burden Loved Ones

Outstanding debts can become a significant issue for your family after you’re gone. Life insurance can help ensure that these debts are paid off, preventing them from becoming a burden on your loved ones. This can provide a sense of security and stability.

By considering these immediate reasons, it becomes clear that securing life insurance is a vital step in protecting your family’s financial future. When to get life insurance is a question that can be answered by understanding the immediate benefits it provides.

4 Long-Term Benefits That Make Life Insurance Worthwhile

Life insurance policies offer a multitude of long-term advantages that can significantly impact your financial security. These benefits not only provide peace of mind but also serve as a strategic component of your overall financial plan.

4. Building Financial Value Through Permanent Policies

Permanent life insurance policies, such as whole life and universal life insurance, accumulate a cash value over time. This cash value can be used to supplement your income, pay for unexpected expenses, or even fund your retirement.

5. Maximizing Tax Advantages and Benefits

Life insurance policies can offer tax-deferred growth on the cash value, meaning you won’t pay taxes on the gains until you withdraw them. Additionally, the death benefit is generally tax-free to your beneficiaries.

6. Supplementing Your Retirement Strategy

The cash value accumulated in a permanent life insurance policy can be a valuable resource in retirement. You can borrow against the policy or use it to supplement your retirement income, helping to ensure a more comfortable retirement.

7. Securing Your Family’s Lifestyle and Future Goals

Life insurance can help ensure that your family’s lifestyle and future goals are protected, even if you’re no longer there to provide for them. Whether it’s funding your children’s education or maintaining your spouse’s standard of living, life insurance can provide the necessary financial support.

| Long-Term Benefit | Description | Advantage |

|---|---|---|

| Building Financial Value | Cash value accumulation over time | Supplement income or fund retirement |

| Maximizing Tax Advantages | Tax-deferred growth on cash value | Reduce tax liability |

| Supplementing Retirement | Using cash value in retirement | Enhance retirement income |

| Securing Family’s Future | Protecting lifestyle and goals | Ensure financial stability |

Conclusion: Taking the First Step Toward Life Insurance Protection

Understanding why life insurance is needed is crucial in today’s uncertain world. Life insurance provides a protective shield for your family’s financial future, helping to ensure their well-being even if you’re no longer there to support them.

The importance of life insurance lies in its ability to provide financial support for your dependents, cover funeral expenses, and pay off debts, thereby preventing them from becoming a burden on your loved ones.

By securing life insurance, you can build financial value over time, maximize tax advantages, and supplement your retirement strategy, ultimately securing your family’s lifestyle and future goals.

Now that you understand the importance and benefits of life insurance, take the first step towards protecting your loved ones. Explore your life insurance options today and make an informed decision to safeguard your family’s financial future.

FAQ

What is the importance of life insurance, and why is it needed?

Life insurance is essential as it provides a financial safety net for your loved ones in the event of your passing, ensuring they can maintain their lifestyle and achieve their future goals. It is a crucial component of a comprehensive financial plan, offering protection and peace of mind.

How does life insurance act as a protective shield for my family’s financial future?

Life insurance provides a death benefit that can help replace your income, pay off outstanding debts, and cover funeral expenses, thereby safeguarding your family’s financial well-being and future.

What are the benefits of having a life insurance policy?

Having a life insurance policy offers numerous benefits, including financial protection for your dependents, coverage for funeral and end-of-life expenses, and the potential to build cash value over time, which can be used to supplement your retirement income or achieve other long-term goals.

When should I consider getting life insurance coverage?

It’s advisable to consider life insurance as soon as you have dependents or significant financial obligations, such as a mortgage or other debts, to ensure that your loved ones are protected in the event of your passing.

What are the different life insurance policy options available?

There are various life insurance policy options, including term life insurance, whole life insurance, universal life insurance, and variable life insurance, each offering distinct features and benefits that can be tailored to meet your individual needs and financial goals.

How can life insurance help in securing my family’s future and lifestyle?

Life insurance can help ensure that your family’s lifestyle and future goals are maintained by providing a financial safety net, paying off debts, and offering a potential source of funds for long-term needs, such as education expenses or retirement.

Can life insurance be used as a retirement strategy?

Yes, certain types of life insurance, such as whole life or universal life insurance, can be used to supplement your retirement income by accumulating cash value over time, which can be borrowed against or used to pay premiums.