Figuring out the right amount of life insurance coverage can be a daunting task. With so many variables to consider, it’s easy to feel overwhelmed. Fortunately, personal finance expert Dave Ramsey has a straightforward formula to help you determine the coverage you need.

Dave Ramsey’s approach focuses on providing a simple, yet effective way to calculate your life insurance needs. By following his guidance, you can ensure that your loved ones are protected in the event of your passing.

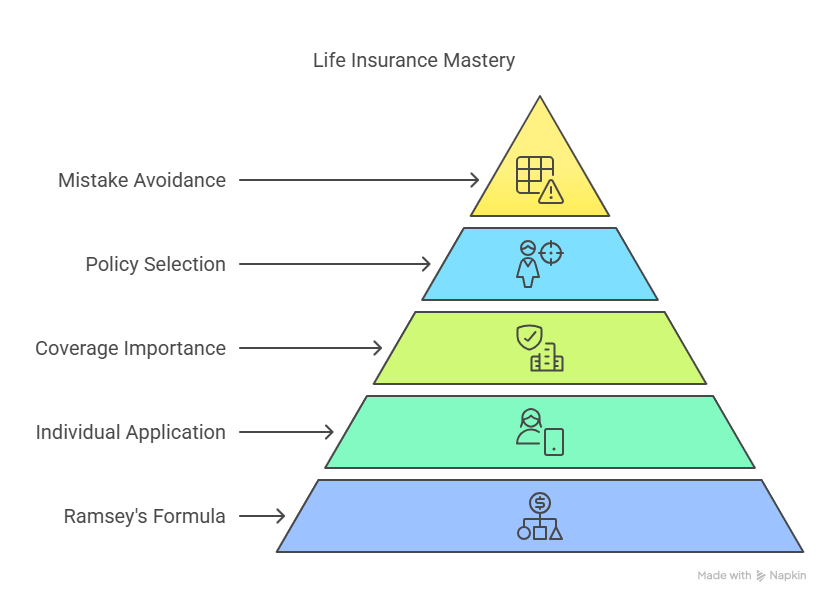

Key Takeaways

- Understand Dave Ramsey’s formula for calculating life insurance needs

- Learn how to apply the formula to your individual circumstances

- Discover the importance of having adequate life insurance coverage

- Get guidance on how to choose the right life insurance policy

- Find out how to avoid common mistakes when selecting life insurance

Understanding Dave Ramsey’s Life Insurance Philosophy

When it comes to life insurance, Dave Ramsey advocates for a straightforward approach that prioritizes affordability and adequacy. This philosophy is rooted in his broader financial principles, which emphasize debt reduction and wealth building.

Why Dave Ramsey Recommends Term Life Insurance

Dave Ramsey recommends term life insurance because it provides ample coverage at an affordable price. Unlike permanent life insurance, term life insurance doesn’t build cash value, but it allows individuals to secure significant coverage for a specified term, usually 10, 15, or 20 years, at a fraction of the cost.

How Dave’s Approach Differs from Traditional Insurance Advice

Dave Ramsey’s approach to life insurance diverges from traditional advice by focusing on term life insurance and dismissing whole life insurance as an unnecessary expense for most people. This stance is based on the belief that investments should be handled separately from life insurance, allowing individuals to make more informed financial decisions.

How Much Life Insurance Do I Need? Dave Ramsey’s Formula

Dave Ramsey’s formula for life insurance provides a straightforward approach to calculating coverage needs. This formula is designed to help individuals determine the appropriate amount of life insurance based on their income and financial obligations.

The 10-12 Times Income Rule Explained

Dave Ramsey recommends purchasing life insurance coverage that is 10 to 12 times your annual income. This rule is based on the idea that your life insurance coverage should be sufficient to replace your income for a certain period, allowing your dependents to maintain their standard of living in your absence. For example, if you earn $50,000 per year, you should consider getting life insurance coverage between $500,000 and $600,000.

Calculating Your Personal Coverage Amount

To calculate your personal coverage amount using Dave Ramsey’s formula, start by determining your annual income. Then, multiply this number by 10 and 12 to get your coverage range. Consider your financial obligations, such as mortgage, debts, and future expenses like college tuition for your children. You can use a life insurance coverage calculator to help you estimate your needs more accurately.

Choosing the Right Term Length

Once you have determined your coverage amount, you need to decide on the term length of your life insurance policy. Dave Ramsey suggests choosing a term that aligns with your financial responsibilities. For instance, if you have young children, you may want a term that covers you until they are financially independent. Common term lengths range from 10 to 30 years. When calculating life insurance needs, consider how long your dependents will rely on your income.

Using a coverage amount calculator can also help you fine-tune your life insurance needs based on your specific situation.

Adjusting Dave Ramsey’s Formula for Your Situation

Adjusting Dave Ramsey’s life insurance formula to fit your specific situation is key to ensuring you have the right coverage. While the basic principle of the 10-12 times income rule provides a solid foundation, individual circumstances such as family size, income structure, and financial obligations can significantly impact your life insurance needs.

Special Considerations for Families with Children

For families with children, it’s essential to consider the cost of raising them until they become financially independent. This might involve increasing your coverage to account for future expenses such as education costs. A life insurance planner can help you calculate the appropriate amount.

Coverage Needs for Single-Income Households

Single-income households may require more extensive coverage to ensure that the surviving family members can maintain their standard of living. Consider factors like outstanding debts and future income replacement when determining your optimal life insurance coverage.

Common Mistakes When Calculating Life Insurance Needs

One common mistake is underestimating the amount of coverage needed. Others include not considering inflation or failing to review and adjust policies regularly. Being aware of these pitfalls can help you avoid them and ensure you’re adequately protected.

| Household Type | Considerations | Recommended Coverage |

|---|---|---|

| Families with Children | Education costs, daily expenses | 10-12 times income + additional for education |

| Single-Income Households | Outstanding debts, future income replacement | Higher coverage to maintain living standards |

| Dual-Income Households | Combined income, debts, future expenses | Coverage based on combined financial obligations |

By understanding these factors and adjusting Dave Ramsey’s formula accordingly, you can determine how much life insurance you need and ensure you’re making the most of his advice.

Conclusion: Implementing Dave Ramsey’s Life Insurance Advice

By following Dave Ramsey’s life insurance guidance, you can ensure that you have the right coverage to protect your loved ones. The key is to determine how much life insurance you need based on your income, expenses, and financial obligations.

Dave Ramsey’s formula, which recommends term life insurance coverage equal to 10-12 times your income, provides a straightforward way to calculate your coverage needs. Adjusting this formula based on your individual circumstances, such as having children or being a single-income household, will help you make informed decisions.

By implementing Dave Ramsey’s advice, you can secure your family’s financial future and enjoy peace of mind knowing that you are prepared for the unexpected. Take control of your life insurance needs today and start protecting those who matter most.

FAQ

What is the recommended amount of life insurance coverage according to Dave Ramsey?

Dave Ramsey recommends having 10-12 times your annual income in life insurance coverage. This can be calculated using a life insurance coverage calculator or by manually determining your coverage needs.

How do I determine my life insurance coverage needs?

To determine your life insurance coverage needs, you can use Dave Ramsey’s formula, which suggests having 10-12 times your annual income in coverage. You can also consider factors like outstanding debts, funeral expenses, and the number of dependents you have.

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specified period, whereas whole life insurance covers you for your entire lifetime. Dave Ramsey recommends term life insurance as it is generally more affordable and provides the coverage you need when you need it most.

How do I choose the right term length for my life insurance policy?

When choosing a term length, consider how many years you need coverage. For example, if you have young children, you may want a term that covers them until they are financially independent. You can also consider your mortgage term and other financial obligations.

Can I adjust Dave Ramsey’s formula to fit my individual circumstances?

Yes, you can adjust Dave Ramsey’s formula based on your individual circumstances, such as having children or being a single-income household. It’s essential to consider your unique situation when determining your life insurance coverage needs.

What are some common mistakes to avoid when calculating life insurance needs?

Common mistakes include underestimating your coverage needs, not considering inflation, and failing to account for outstanding debts. It’s crucial to carefully assess your financial situation to determine the optimal life insurance coverage.

How often should I review my life insurance coverage?

It’s a good idea to review your life insurance coverage regularly, especially when significant life events occur, such as having children, getting married, or changing jobs. This ensures you have the right amount of coverage to protect your loved ones.